Live Nation Class Action Lawsuit Litigation Report

Levi & Korsinsky, LLP

April 26, 2018

On April 18, 2018, investors brought a securities class action lawsuit against Live Nation Entertainment, Inc. (“Live Nation” or the “Company”) in United States District Court, Central District of California. Plaintiffs in the federal securities class action allege that they acquired Live Nation stock at artificially inflated prices between February 23, 2017 and March 30, 2018 (the “Class Period”). They are now seeking compensation incurred upon public revelation of the Company’s alleged misconduct during that time. Here’s what we know about the Live Nation class action lawsuit (LYV class action):

Summary of the Allegations

Company Background

According to the April 18 complaint, the Company (NYSE: LYV) produces live concerts and sells tickets to those events on the Internet. It also owns and operates nearly 200 venues globally.

The Company says one of its events is happening somewhere in the world every 18 minutes. In all, Live Nation says, it provides entertainment for 550 million fans in 40 countries around the world.

In 2010, the Company “significantly expanded its ticketing services” with the acquisition of Ticketmaster Entertainment (“Ticketmaster”). The Company’s representations about its compliance with an anti-trust consent decree issued following the acquisition is at the crux of the current lawsuit.

Summary of Facts

Live Nation and three of its officers and or directors are now accused of lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about its compliance with and ability to comply with the consent decree from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Live Nation’s stock to trade at artificially inflated prices.

The truth emerged in an article published by The New York Times after the market closed on April 1, 2018. The story alleged that Live Nation didn’t abide by the terms of the consent decree that had been issued to “prevent Live Nation and Ticketmaster from monopolizing the market for live musical performances.”

A closer look…

As alleged in the April 18 complaint, the Company repeatedly made misleading public statements during the Class Period.

For example, when the Class Period began on February 23, 2017, the Company filed an annual report with the SEC, saying in pertinent part: “we believe that we are materially in compliance with [federal, state and local laws] … governing primary ticketing and ticket resale services.”

On another form filed with the SEC on August 9, 2017, the Company said in pertinent part: “Our concerts business is our flywheel, selling over 68 million tickets to shows this year through July, 12 million more tickets than at this point last year.”

What the Company failed to disclose, however, was that it hadn’t complied with the consent decree, that it “lacked internal controls to prevent a violation of the consent decree.”

Impact of the Alleged Fraud on Live Nation’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$41.14 |

| Closing stock price the trading day after disclosures:

|

$38.17 |

| One day stock price decrease (percentage) as a result of disclosures:

|

9.42% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is June 18, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Live Nation common stock using court approved loss calculation methods.

Recently Filed Cases

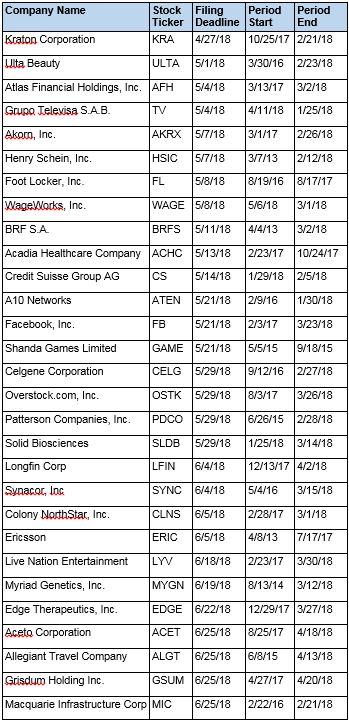

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

| This information is provided for general information purposes only, and should not be construed as legal advice, nor does it establish an attorney-client relationship with Levi & Korsinsky LLP. Any and all information herein is simply an opinion based on publicly available information and should not necessarily be construed as fact. For more information, please visit our website at www.zlk.com.

Attorney Advertising

|

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.