SBGL Class Action Report

Levi & Korsinsky, LLP

July 6, 2018

On June 27, 2018, investors sued Sibanye Gold Limited (“Sibanye” or the “Company”) in United States District Court, Eastern District of New York. Plaintiffs in the federal securities class action allege that they acquired Sibanye’s American Depository Receipts (ADRs) at artificially inflated prices between April 7, 2017 and June 26, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. Here’s everything you need to know about the Sibanye class action (SBGL class action):

Summary of the Allegations

Company Background

Sibanye (NYSE: SBGL) engages in the mining of precious metals in South Africa, Zimbabwe and the United States.

Its history dates to February 2013, when GFI Mining South Africa listed as Sibanye on the Johannesburg Stock Exchange. The Company’s ADRs have also been listed on the New York Stock Exchange since that time.

Sibanye is incorporated in the Republic of South Africa, where it also maintains its primary executive offices.

Summary of Facts

Sibanye and two of its senior officers now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about mining safety from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Sibanye’s ADRs to trade at artificially inflated prices during the time in question.

The truth came out in a series of articles published between June 13, 2018 and June 27, 2018. The first article, published by Mercury, stated that, “Company supervisors forced and intimidated miners to work in dangerous conditions.”

Then, an article published by Bloomberg before the market opened on June 26, reported that, “another worker was killed at [Sibanye’s] Driefontein operation in South Africa, brining the total deaths at the company’s mines this year to 21.” The article also stated that Sibanye “accounts for nearly half of the 46 people reported killed at South African mines in 2018 and is already the subject of an investigation by the chief inspector of mines.”

Another article published by Bloomberg before the market opened the next day reported that “Citigroup Inc. cut their recommendation on the stock to neutral from buy, citing the Company’s ‘track record’ from both an ‘environmental, social and governance perspective, as well as the underlying investment risk that it holds.’”

A closer look…

As alleged in the June 27 complaint, the Company repeatedly made misleading public statements during the Class Period.

For example, on a form filed with the SEC at the beginning of the Class Period, the Company said in pertinent part: “Our employees are our most important asset. In order to keep our workforce safe and healthy, we focus on compliance and systematically reducing employees’ exposure to risk.”

Then, on another form filed with the SEC on April 2, 2018, the Company reaffirmed its commitment to safety, saying in relevant part: “Safety is our principal value and we continue to focus significant effort and attention as well as resources on ensuring that our employees are able to work in a safe and conducive environment.”

Impact of the Alleged Fraud on Sibanye’s ADR Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$2.82 |

| Closing stock price the trading day after disclosures:

|

$2.51 |

| One day stock price decrease (percentage) as a result of disclosures:

|

10.99% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is August 27, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Sibanye’s ADRs using court approved loss calculation methods.

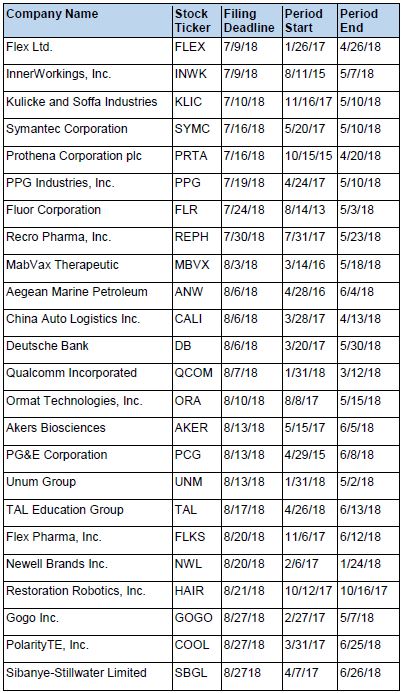

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

| This information is provided for general information purposes only, and should not be construed as legal advice, nor does it establish an attorney-client relationship with Levi & Korsinsky LLP. Any and all information herein is simply an opinion based on publicly available information and should not necessarily be construed as fact. For more information, please visit our website at www.zlk.com.

Attorney Advertising

|

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.