AAOI Lawsuit; Levi & Korsinsky Announces AAOI Class Action

Levi & Korsinsky, LLP

October 18, 2018

Case Introduction

Taneja v. Applied Optoelectronics, Inc., et al 4:18-cv-3544 — On October 1, 2018, investors sued Applied Optoelectronics, Inc., (“Applied Optoelectronics” or the “Company”) in United States District Court for the Southern District of Texas, Houston Division. Plaintiffs in the AAOI class action allege that they acquired Applied Optoelectronics stock at artificially inflated prices between August 7, 2018 and September 27, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the AAOI lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, the Company (NASDAQ: AAOI) is a “leading provider of fiber‑optic networking products. We serve three growing end-markets: Cable Television Broadband (CATV), fiber-to-the-home (FTTH), and internet data centers (Data Center).”

As such, the Company says it designs and makes “a range of optical communications products employing our vertical integration strategy from laser chips, components, subassemblies and modules to complete turn-key equipment.” Specifically, the Company says, it makes, designs and incorporates its own “analog and digital lasers using a proprietary Molecular Beam Epitaxy (MBE) fabrication process,” which it believes to be the only one of its kind in the industry.

Of importance here, however, are the Company’s claims that its lasers “are proven to be reliable over time and highly tolerant of changes in temperature and humidity (delivering millions of hours service), making them well-suited to the CATV and FTTH markets where networking equipment is often installed outdoors.”

Summary of Facts

Applied Optoelectronics and two of its senior officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about the reliability of some of its products from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Applied Optoelectronics stock to trade at artificially inflated prices during the time in question.

The truth came out in a report made by a Loop Capital Markets analyst on September 27, 2018. The analyst reported that, “the Company was experiencing product quality issues with certain transceivers in which its lasers failed after thousands of hours of operation.” In addition to downgrading the Company’s stock, the analyst “lowered gross margin and revenue expectations because the product quality issues suggested that the Company would start procuring lasers externally through 2019.”

The next day, the Company “cut its revenue guidance for the third quarter 2018 because it had identified an issue with its lasers that caused them to temporarily suspend shipments of certain transceivers.”

A closer look…

As alleged in the October 1 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For instance, in a press release issued by Applied Optoelectronics on August 7, 2018, one of the Individual Defendants said in pertinent part: “We remain confident in our competitive position. We believe our platform, proprietary manufacturing processes and vertical integration are keys to our success in the market, and remain focused on building on this strong foundation to position AIO for further success.”

In the same press release, the Company shared its Business Outlook for the third quarter of 2018. Among other things, its expectations included revenue in the range of $82 million to $92 million.

The Company shared the same financial information on a form filed with the SEC the next day.

What Applied Optoelectronics failed to disclose, however, was that some of its lasers were “susceptible to fail prematurely,” and that “certain of the Company’s transceivers utilizing these lasers would be materially affected.”

Impact of the Alleged Fraud on Applied Optoelectronics Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$28.36 |

| Closing stock price the trading day after disclosures:

|

$24.66 |

| One day stock price decrease (percentage) as a result of disclosures:

|

13.05% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is November 30, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Applied Optoelectronics common stock using court approved loss calculation methods.

Recently Filed Cases

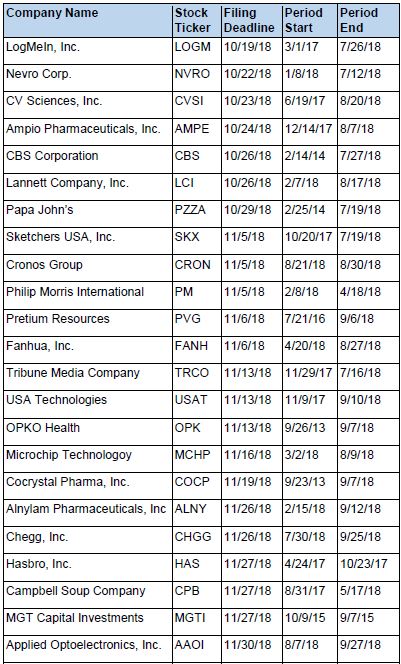

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.