Levi & Korsinsky Announces APOG Lawsuit; APOG Class Action

Levi & Korsinsky, LLP

December 12, 2018

On November 5, 2018, investors sued Apogee Enterprises, Inc., (“Apogee” or the “Company”) in United States District Court, District of Minnesota. The APOG class action alleges that plaintiffs acquired Apogee stock at artificially inflated prices between June 28, 2018 and September 17, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the APOG Lawsuit, please contact us today!

Summary of the Allegations

Company Background

Apogee (NASDAQ: APOG) is a self-described “industry leader in architectural products and services.” As such, it says it derives the bulk of its revenue through its architectural glass, metal and installation businesses.

The Company’s history dates to 1949. Eventually, the business that began with just one auto glass shop expanded to provide architectural glass installation and window framing. In 1971, Apogee went public, offering 250,000 shares.

Today, Apogee has eight operating companies, 12 manufacturing and fabrication facilities in the United States, and 13 overseas.

Summary of Facts

Apogee and two of its senior officers (the “Individual Defendants”) are now accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices, operations and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about its labor force and ability to hire new employees from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Apogee stock to trade at artificially inflated prices during the time in question.

The truth came out in a press release issued by the Company on September 18, 2018. In it the Company revealed the operating income for its glass segment was $1.7 million, compared to $10.3 million in the “previous year’s comparable quarter.” The Company blamed the poor performance on “significantly increased labor costs, lower productivity, and higher cost of quality, as the segment was challenged to efficiently ramp-up production to meet the higher than expected, short lead-time customer demand.” It also reduced its financial guidance.

Then on an ensuing conference call to discuss its financial and operating results for the second fiscal quarter of 2018, one of the Individual Defendants admitted “Apogee was never ready to ramp-up production and meet the previously announced growth and margins,” that Defendants “were aware of labor market trends,” and that they did nothing to address them.

A closer look…

As alleged in the November 5 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a press release regarding the Company’s financial and operating results for the first fiscal quarter of 20, which was issued at the beginning of the Class Period, the Company stated in relevant part: “We also continued to make progress positioning the company for long-term, stable earnings and cash flow growth, regardless of the economic cycle.”

In the same press release, the Company also said in pertinent part: “On this strong foundation, we continued making investments and process improvements to increase efficiencies in project selection, manufacturing and delivery to raise long-term operating margins and drive earnings.”

Then, during an ensuing conference call to discuss the Company’s fiscal first quarter 2018 results, one of the Individual Defendants stated in pertinent part: “…order activity for Architectural Glass grew substantially during the quarter and we continue to expect higher revenues sequentially in Q2 and year-over-year revenue in operating income growth for the remainder of the year.”

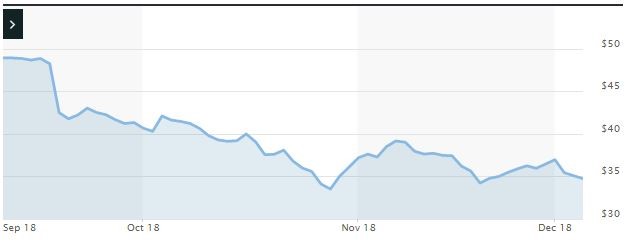

Impact of the Alleged Fraud on Apogee’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$48.22 |

| Closing stock price two trading days after disclosures:

|

$41.76 |

| Two day stock price decrease (percentage) as a result of disclosures:

|

13.40% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is January 4, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Apogee common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us today!