Levi & Korsinsky Announces BLUE Lawsuit; BLUE Class Action

Levi & Korsinsky, LLP

January 2, 2019

Lind v. bluebird bio, Inc., et al 1:18-cv-12556 — On December 12, 2018, investors sued bluebird bio, Inc. (“bluebird” or the “Company”) in United States District Court, District of Massachusetts. Plaintiffs in the federal securities class action allege that they acquired bluebird stock at artificially inflated prices between December 11, 2017 and November 29, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the BLUE lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, bluebird (NASDAQ: BLUE) is a clinical-stage company “committed to developing potentially transformative gene therapies for severe genetic diseases and T cell-based immunotherapies.”

As such, its primary goal is “is to develop and bring to market the most advanced products based on the transformative potential of gene therapy to provide patients hope for a better life in the face of limited or no long-term safe and effective treatment options.”

The December 12 complaint also details the steps bluebird is taking to meet its objective. Specifically, the Company is conducting five clinical studies of LentiGlobin, its lead product candidate for the treatment of sickle cell disease (“SCD”) in the U.S. and abroad.

The Company’s claims about the efficacy of LentiGlobin are at the crux of the December 12 complaint.

Summary of Facts

The Company and two of its senior officers (the “Individual Defendants”) are now accused of deceiving investors by lying and/or withholding critical information about bluebird’s business practices, occupational and compliance policies during the Class Period.

Specifically, they are accused of omitting truthful information about the efficacy of LentiGlobin from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused bluebird stock to trade at artificially inflated prices during the time in question.

The truth came out in a December 3, 2018 press release that the Company actually issued on December 1, 2018. In it, the Company informed investors that it had announced “new long-term data” from one completed and one ongoing study involving LentiGlobin at an American Society of Hematology (“ASH”) meeting.

Then, on December 3, 2018, Seeking Alpha published an article reporting that the results announced by bluebird “were lower than initial data reported a year ago indicating a lower rate of production of anti-sickling hemoglobin.”

A closer look…

As alleged in the December 12 complaint, bluebird and/or the Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a press release issued by bluebird at the beginning of the Class Period, the Company’s chief medical officer said in relevant part: “All three patients with severe SCD in the HGB-205 study showed a steady increase in HbAT87Q production in the first six months following LentiGlobin therapy, with the longest-treated patient showing stable hemoglobin levels over two and a half years.”

Then on a form filed with the SEC on February 21, 2018, the Company provided “Updated Clinical Data for the LentiGlobin product candidate in subjects with TDT or severe SCD.” In this context bluebird stated in relevant part: “It should be noted that these data presented above are current as of the data cut-off date, are preliminary in nature and our Northstar Study is not complete. There is limited data concerning long-term safety and efficacy following treatment with our LentiGlobin product candidate.”

Finally, on a form filed with the SEC on May 2, 2018, the Company stated in relevant part: “For efficacy, we believe that the Northstar Study and supportive ongoing HGB-205 study, together with the data available from our ongoing Northstar-2 Study and our long-term follow-up study LTF-303, could support the filing of a marketing authorization application in the European Union.”

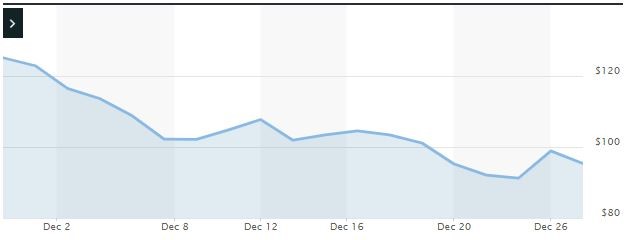

Impact of the Alleged Fraud on bluebird’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$122.89 |

| Closing stock price the trading day after disclosures:

|

$116.50 |

| One day stock price decrease (percentage) as a result of disclosures:

|

5.20% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in bluebird common stock using court-approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.