Levi & Korsinsky Announces CAG Lawsuit; CAG Class Action

Levi & Korsinsky, LLP

March 19, 2019

West Palm Beach Firefighters’ Pension Fund v. Conagra Brands, Inc. et al 1:19-cv-01323 — On February 22, 2019, investors sued Conagra Brands, Inc., (“Conagra” or the “Company”) in United States District Court, Northern District of Illinois Eastern Division. Plaintiffs in the CAG class action allege that they acquired Conagra stock at artificially inflated prices between June 27, 2018 and December 19, 2018 (the “Class Period”); or that they did so based on statements in Offering Documents related to the Company’s secondary public offering on or about October 9, 2018. They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during those times. For more information on the CAG lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Chicago-based Company (NYSE: CAG) makes and promotes packaged foods for retail customers and the food service industry.

According to its website, the Company has operations in approximately 50 locations. Conagra also has more than 17,000 employees and generates $11 billion in revenue. Its brand portfolio includes dozens of well-known food products.

On June 27, 2018, the Company announced that it acquired Pinnacle in a “cash and stock transaction valued at approximately $10.9 billion (the “Transaction”). Conagra secured some of the funding for the acquisition through a secondary public offering initiated on or about October 9, 2018.

In addition to the Company’s statements during the Class Period, Conagra’s statements in Offering Documents related to the SPO are at the crux of the February 22 complaint.

Summary of Facts

Conagra and two of its senior officers and/or directors (the “Individual Defendants”) now stand accused of lying and withholding critical information about the Company’s business practices, operations and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about Conagra’s acquisition of Pinnacle from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Conagra stock to trade at artificially inflated prices during the time in question.

Numerous Conagra officers and directors, and 15 other businesses that helped with the preparation and issuance of, and or signed the Offering Documents related to the SPO are also named as defendants in the February 22 complaint.

The truth came out in a December 20, 2018 press release in which the Company announced its financial results for the second quarter of fiscal year 2019. The timeframe encompassed the first few weeks after Conagra assumed ownership of Pinnacle. Specifically, the results revealed that, “net sales for the Pinnacle segment” for the first 31 days after closing totaled $259 million, which fell short of expectations “due to a weak performance across a range of significant brands.”

On a conference call held that day, one of the Individual Defendants also acknowledged that there had been a, “deterioration in the legacy Pinnacle business over the course of the calendar year 2018” as “growth stalled” for three of Pinnacle’s most significant brands.

Following the disclosures, analysts weighed in, questioning the Company’s due diligence prior to the acquisition.

A closer look…

As alleged in the February 22 complaint, Conagra and/or the Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a conference call held at the beginning of the Class Period to discuss the Transaction, one of the Individual Defendants said the Company has, “proven track record of executing strategic transactions,” and that it would be able to “implement a smooth integration process.”

Then, at an industry conference held on September 4, 2018, the same Individual Defendant stated in relevant part: “With respect to Pinnacle, this is as much of a no brainer of a deal as I think you’re going to see.”

At the same event, the same Individual Defendant “assured investors that the Company had done a thorough due diligence on Pinnacle, saying in relevant part: “I think the way to think about this is we’ve been looking at this for a while. And we know food businesses. We’ve been spending our whole career in the food industry. So, we’ve been very clear-eyed from the beginning as to what the synergy prospects were with this company…”

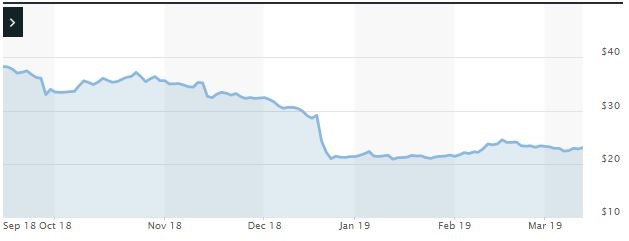

Impact of the Alleged Fraud on Conagra’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$29.09 |

| Closing stock price the trading day after disclosures:

|

$24.28 |

| One day stock price decrease (percentage) as a result of disclosures:

|

16.53% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is April 23, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Conagra common stock using court approved loss calculation methods.

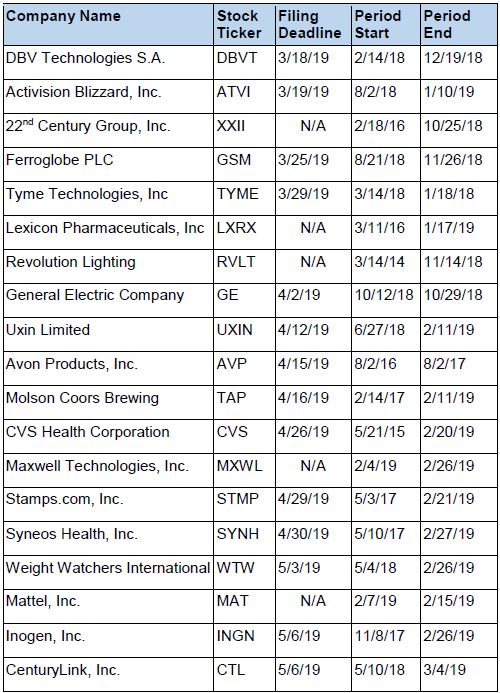

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.