Levi & Korsinsky Announces CMCM Class Action; CMCM Lawsuit

Levi & Korsinsky, LLP

December 14, 2018

Marcu v. Cheetah Mobile, Inc., et al 1:18-cv-11184-JMF — On November 30, 2018, investors sued Cheetah Mobile, Inc., (“Cheetah” or the “Company”) in United States District Court, Southern District of New York. Plaintiffs in the federal securities class action claim that they acquired the Company’s American Depository Receipts (ADRs) at artificially inflated prices between April 26, 2017 and November 27, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of Cheetah’s alleged misconduct during that time. For more information on the CMCM lawsuit, please contact us today!

Summary of the Allegations

Company Background

Cheetah (NYSE: CMCM) is a Chinese business incorporated in 2009 and known as Kingsoft Internet Holdings Limited until it adopted its current moniker in 2014.

As a “mobile Internet company,” Cheetah’s goal is to “provide leading apps for mobile users worldwide and connect users with personalized content powered by artificial intelligence.” According to its website, Cheetah has “attracted approximately 600 million global MAUs [monthly average users] in more than 200 countries and regions, of which approximately 77% are located in Europe and the U.S.”

Cheetah’s products include utility applications, such as Clean Master, Security Master, CM Launcher, Duba Anti-Virus and Cheetah Keyboard. The Company also provides social and gaming apps, such as LiveMe and popular casual games such as Piano Tiles 2, Rolling Sky and Arrow.io.

Summary of Facts

Cheetah and two of its senior officers (the “Individual Defendants”) now stand accused of lying and/or withholding critical information about the Company’s business practices, and its operational and compliance policies during the Class Period.

Specifically, they are accused of failing to disclose truthful information about its acquisition and use of certain data in SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Cheetah stock to trade at artificially inflated prices during the time in question.

The truth came out in a Buzz Feed News article published on November 26, 2018. According to the November 30 complaint, the article reported that the Company’s apps, “tracked when users downloaded new apps and used this data to inappropriately claim credit for having caused the download.” Buzz Feed also reported that, “two of Cheetah’s apps were removed from the Google Play store after publication of the article.”

A closer look…

As alleged in the November 30 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements throughout the Class Period. Some examples follow.

On a form filed with the SEC on April 26, 2017, Cheetah stated in relevant part: “We generate online marketing revenues primarily by providing mobile advertising services to advertisers worldwide, as well as referring user traffic and selling advertisements on our mobile and PC platforms.”

The same form included a certification signed by one the Individual Defendants in accordance with federal law. By signing it, the Individual Defendant attested to, “the accuracy of financial reporting, the disclosure of any material changes to the Company’s internal controls over financial reporting, and the disclosure of all fraud.”

On another form filed with the SEC on April 24, 2018, the Company referred to its “Ability to provide targeted advertising,” and stated in relevant part: We believe that data analytics is a key factor affecting our online marketing revenues. Data analytics enable us to map our users’ interest and distribute targeted advertising to our users. Our ability to effectively conduct user profiling and provide targeted advertising affects advertising engagement and conversion, which affects our online marketing revenues.”

What the Company did not reveal, however was that its apps had, “undisclosed imbedded features which tracked when users downloaded new apps,” that it misused this data, and that the discovery of this misuse “would foreseeably subject the Company’s apps to removal from the Google Play store.” The Company also failed to disclose that revenue generated during the Class Period was “unsustainable” because it was partially derived from improper conduct.

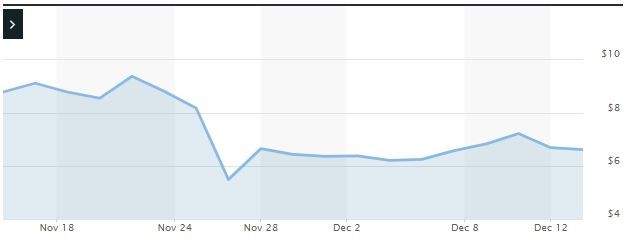

Impact of the Alleged Fraud on Cheetah’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$8.80 |

| Closing stock the trading day after disclosures:

|

$5.48 |

| One day stock price decrease (percentage) as a result of disclosures:

|

37.72% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is January 29, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Cheetah common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.