COCP Lawsuit; Levi & Korsinsky Announces COCP Class Action

Levi & Korsinsky, LLP

October 4, 2018

Pepe v. Cocrystal Pharma, Inc., et al 2:18-cv-14091-KM-JBC — On September 20, 2018, investors sued Cocrystal Pharma, Inc., (Cocrystal, COCP, or the Company) in United States District Court, District of New Jersey. Plaintiffs in the COCP class action allege that they acquired Cocrystal stock at artificially inflated prices between September 23, 2013 and September 7, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the COCP Lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Company (NASDAQ: COCP) was formerly known as BioZone Pharmaceuticals, Inc. (“BioZone”). Its creation resulted from a merger between BioZone and Cocrystal Discovery, Inc., in 2014.

According to its website, Cocrystal is now a “clinical stage biotechnology company discovering and developing novel antiviral therapeutics that target the replication machinery of hepatitis viruses, influenza viruses, and noroviruses.” As such, it uses “unique structure-based technologies and Nobel Prize winning expertise to create first- and best-in-class antiviral drugs.”

Cocrystal is incorporated in Delaware and based in Tucker, Georgia. On its website, the Company identifies its owners as “two private investors,” who own approximately 60 percent of Cocrystal, including the Frost Group. It also identifies OPKO Health, Inc., Brace Pharma Capital, LLC and Teva Pharmaceuticals Industries, Ltd. as “corporate investors.”

Summary of Facts

Cocrystal, six of its former officers and/or directors, and eight additional co-defendants (collectively the “Individual Defendants”) are accused of deceiving investors by lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about the Company’s commission of certain acts and compliance with the SEC’s disclosure rules from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Cocrystal stock to trade at artificially inflated prices during the time in question.

The truth came out when the SEC issued a press release on September 7, 2018. In it, the SEC announced that it charged numerous individuals and “associated entities” for their participation in “long-running fraudulent schemes that generated over $27 million from unlawful stock sales and caused significant harm to retail investors who were left holding virtually worthless stock.” Of significance here is that several people with ties to Cocrystal and/or BioZone are identified as defendants in the SEC’s case.

A closer look…

As alleged in the September 20 complaint, the Company and/or Individual Defendants repeatedly made or caused the issuance of false and misleading public statements during the Class Period.

For example, on September 26, 2013, Seeking Alpha published an article touting BioZone by “using Defendant [Phillip] Frost’s ownership in BioZone and reputation as a successful biotech investor.” The article also “misleadingly stated that BioZone had a formulation ready to be tested and brought to the billion-dollar injectable drug market.”

Furthermore, the author, John H. Ford, failed to disclose that BioZone shareholder Barry C. Honig had paid him to write the article.

Then, along with a form filed with the SEC on March 31, 2014, the Company included certifications signed by two of the Individual Defendants that attested to “the accuracy of financial reporting, the disclosure of any material changes to the Company’s internal control over financial reporting and the disclosure of all fraud.”

The Company included the same, signed certifications along with SEC filings on five additional occasions during the Class Period.

What Cocrystal failed to disclose was that it “engaged in a pump-and-dump scheme to artificially inflate the Company’s stock price,” and that its participation in this activity would result in government scrutiny. Cocrystal also failed to disclose that it failed to “abide by SEC disclosure regulations.”

Impact of the Alleged Fraud on Cocrystal’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$3.74 |

| Closing stock price two trading days after disclosures:

|

$3.16 |

| One day stock price decrease (percentage) as a result of disclosures:

|

15.51% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is November 19, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Cocrystal common stock using court approved loss calculation methods.

Recently Filed Cases

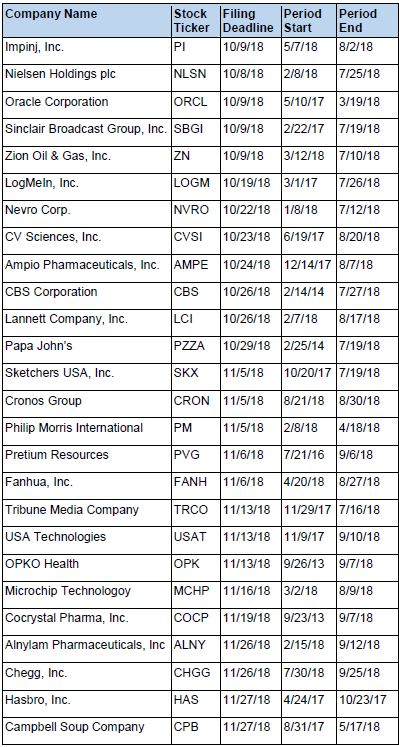

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.