Levi & Korsinsky Announce CTL Lawsuit; CTL Class Action

Levi & Korsinsky, LLP

April 11, 2019

Caliendo v. CenturyLink, Inc. et al 2:19-cv-01629-CBM_GJS — On March 6, 2019, investors sued CenturyLink, Inc. (“CenturyLink” or the “Company”) in United States District Court, Central District of California. The CTL class action alleges that plaintiffs acquired CenturyLink stock at artificially inflated prices between May 10, 2018 and March 4, 2019 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the CTL Lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Company (NYSE: CTL) bills itself as “the second largest U.S. communications provider to global enterprise customers.”

In this role the Company says it provides numerous communications services to customers in the residential, business, wholesale and government sectors.

The Company, which adopted its current name in 2009, can trace its history to 1930, when William Clarke and Marie Williams purchased the Oak Ridge Telephone Company for $500 from F.E. Hogan, Sr. Back then, there were just 75 paid subscribers and the family operated the switchboard from Williams’ home.

Thirty-eight years after its inception, the business was incorporated as Central Telephone and Electronics. By this time, the Company had enjoyed considerable growth, serving 10,000 access lines in three states, under the leadership of Clarke M. Williams.

The Company continued to evolve through a series of transactions over the years. According to its website, CenturyLink finalized its acquisition of Level 3 Communications, Inc., in November 2017. CenturyLink claimed that by doing so, it allowed its network to connect “more than 350 metropolitan areas with more than 100,000 fiber-enabled, on-net buildings…” CenturyLink’s claims about this acquisition are at the crux of the March 6 complaint.

Summary of Facts

CenturyLink and five of its current and former officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices, operational and financial results during the Class Period.

Specifically, they are accused of omitting truthful information about CenturyLink’s internal controls over certain accounting practices, including those related to the Level 3 Communications acquisition, from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused CenturyLink stock to trade at artificially inflated prices during the time in question.

The truth came out on March 4, 2019. That day, the Company announced it would not be able to meet the deadline for filing its annual report for the period ended December 31, 2018. It then attributed the delay to the discovery of “material weakness in internal controls over the Company’s revenue recording processes and the procedures for measuring assets and liabilities” related to the acquisition of Level 3 Communications, and the ensuing need for “additional review an testing with respect to those processes…”

A closer look…

As alleged in the March 6 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, on a form filed with the SEC on May 10, 2018, CenturyLink said in relevant part: “Management will continue to evaluate the Company’s controls over financial reporting as it continues the integration of Level 3.”

On another form filed with the SEC on August 9, 2018, the Company also stated in pertinent part: “Other than the internal controls related to the adoption of ASC 606 referenced above, there were no changes in the Company’s internal control over financial reporting that occurred during the second quarter of 2018 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.”

Finally, on a form filed with the SEC on November 9, 2018, CenturyLink stated in relevant part: “We will continue to evaluate our internal controls over financial reporting as we continue the integration of Level 3.”

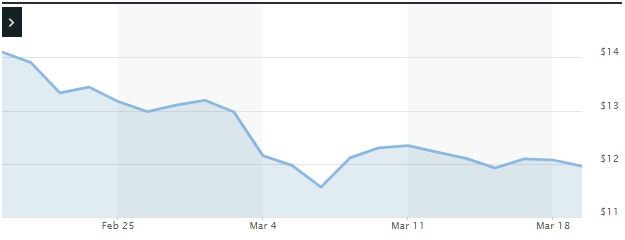

Impact of the Alleged Fraud on CenturyLink’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$12.97 |

| Closing stock price the trading day after disclosures:

|

$12.15 |

| One day stock price decrease (percentage) as a result of disclosures:

|

6.32% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is May 6, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in CenturyLink common stock using court-approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.