Levi & Korsinsky Investigate DNKEY Lawsuit; DNKEY Class Action

Levi & Korsinsky, LLP

January 31, 2019

Plumbers & Steamfitters Local 773 Pension Fund v. Danske Bank A/S et al 1:19-cv-00235-VEC — On January 9, 2019, investors sued Danske Bank A/S (“Danske Bank” or the “Company”) in United States District Court, Southern District of New York. Plaintiffs in the DNKEY class action allege that they acquired Danske Bank’s American Depository Receipts (ADRs) at artificially inflated prices between January 9, 2014 and October 23, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more on the DNKEY lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, Danske Bank (OTC: DNKEY) is a “Nordic bank with strong local roots and bridges to the rest of the world.”

The Company’s history dates to the founding of Den Danske Landmandsbank in 1871. Throughout its existence, the Company strengthened its business by merging with “many local and regional banks.” In 1990, Danske Bank became the largest bank in Denmark by merging with two other “major Danish banks.”

As such, the Company says, it provides personal and commercial banking services to its customers. Additional services provided by the Company include life insurance and pension, mortgage credit, wealth management, real estate and leasing.

In all, Danske Bank now has operations in 16 countries. It also has more than 200 branches and more than 20,000 employees. Collectively they serve 2.8 million personal and business customers and more than 1,800 corporate and institutional customers.

Today, Danske Bank identifies its “core markets” as Denmark, Finland, Norway and Sweden. However, the Company’s failure to fully disclose the extent of alleged criminal conduct at its Estonian branch is at the crux of the January 9 complaint.

Summary of Facts

Danske Bank and four of its former officers and/or directors (the “Individual Defendants) are now accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they stand accused of omitting truthful information about the nature of certain activities at Danske Bank’s Estonian branch, their knowledge of such activities, and ancillary matters from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Danske Bank’s ADRs to trade at artificially inflated prices during the time in question.

The truth emerged in a series of news reports, press releases, social media posts and announcements made or issued between September 5, 2017, and October 23, 2018. Collectively, these revelations chronicled the extent of alleged money laundering at Danske Bank’s Estonia branch; the investigation of said activity; how much certain Danske Bank executives knew about it; the resignation of certain Company executives; and more.

A closer look…

As alleged in the January 9 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in an Annual Report published on February 6, 2014, the Company discussed its Estonian branch, saying in relevant part: “At the beginning of 2007, Danske Bank acquired the Baltic activities of the Sampo Bank group. The activities form part of the business structure of Danske Bank Group. With the acquisition, the Group established a presence in the Baltic markets, primarily in Estonia and to a lesser extent, in Lithuania. Only the goodwill allocated to the Estonian operations remains capitalised. In 2013, goodwill in Banking Activities Baltics was reallocated to Business Banking Estonia as a result of the new organizational structure.”

Then, in another Annual Report published on February 3, 2015, the Company again discussed its Estonian branch, saying in pertinent part: “In 2014, the Group recognized a goodwill impairment corresponding to the full amount of the goodwill owing to a worsening of the long-term economic outlook in Estonia and the planned repositioning of the personal banking business in 2015.”

Finally, in another Annual Report published on February 2, 2016, the Company attributed positive financial results to its “purported ongoing operational and strategic prowess, rather than to the money laundering the whistleblower had already disclosed to Danske Bank’s senior executives during 2013.”

Specifically, one of the Individual Defendants then said in pertinent part: “In 2015, Danske Bank continued to progress and delivered strong results despite a challenging environment. The results are a testament to the strength of our diversified business model as a Nordic universal bank and reflect our firm focus on executing our strategy of becoming a more customer-centric, simple and efficient bank…”

Impact of the Alleged Fraud on Danske Bank’s Stock Price and Market Capitalization

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is March 11, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Danske Bank common stock using court approved loss calculation methods.

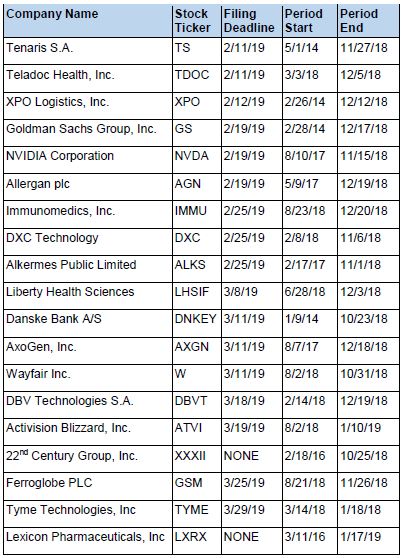

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.