Levi & Korsinsky Announces DY Class Action; DY Lawsuit

Levi & Korsinsky, LLP

November 9, 2018

Tung v. Dycom Industries, Inc., et al 9:18-cv-81448-RLR — On October 25, 2018, investors sued Dycom Industries, Inc. (“Dycom” or the “Company”) in United States District Court, Southern District of Florida. The DY Class Action alleges that plaintiffs acquired Dycom stock at artificially inflated prices between November 20, 2017 and August 10, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the DY Lawsuit, please contact us today!

Summary of the Allegations

Company Background

Dycom (NYSE: DY) engages in the provision of “specialty contracting services” through its subsidiaries throughout the United States, and in Canada.

These include: program management, engineering, construction, maintenance and installation services for telecommunications providers; underground facility locating services for various utilities; and “other construction and maintenance services” for electric and gas utilities.

Dycom is incorporated in Florida, and its principal offices are located in Palm Beach Gardens, Florida. According to its website, Dycom has more than 14,000 employees and 500 field offices.

According to the October 25 complaint, the Company had more than 31.2 million shares of common stock outstanding as of August 29, 2018.

Summary of Facts

The Company and two of its officers (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about the Dycom’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about the Company’s reliance on permitting and tactical considerations for large projects, and ancillary issues from SEC filings and related materials. By knowingly or recklessly doing so, they allegedly caused Dycom stock to trade at artificially inflated prices during the time in question.

The truth emerged in a series of events that transpired on May 22, 2018 and August 13, 2018. Before the market opened on May 22, Dycom issued a press release in which it announced that it was “revising is financial guidance for the 2019 fiscal year ending January 26, 2019 to reflect the actual results for the quarter ended April 28, 2018 and the anticipated timing of activity on large customer programs and the related impacts on revenues and margins.”

Then, on August 13, Dycom issued another press release in which it revised its guidance for the “financial and operating results for the second fiscal quarter and six months ended July 28, 2018,” and announced “preliminary revenues and results for the second quarter below the previous guidance.”

During a conference call to discuss these matters, one of the Individual Defendants said in pertinent part: “These preliminary results were impacted by large scale deployments that were slower than expected during the quarter, due to customer timing and tactical considerations and margins that were pressured from under-absorption of labor and field costs to the lower revenue level.”

A closer look…

As alleged in the October 25 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, during a November 20, 2017 conference call to discuss the Company’s financial and operating results for the first fiscal quarter ended October 28, 2017, one of the Individual Defendants said in pertinent part: “Engineering and construction activity is expected to increase throughout the balance of our second quarter and accelerate into calendar 2018. Customers are continuing to reveal with specificity new multi-year initiatives that are being planned and managed on a market-by-market basis.”

On the same conference call, the same Individual Defendant also said in relevant part: “As with prior initiations of large-scale network deployments, we expect some normal timing volatility and customer spending modulations as network deployment strategies evolve and tactical considerations, primarily permitting impact timing.”

Finally, during the same call, the second Individual Defendant also addressed the impact of new large projects on the gross margin, saying in relevant part: “We expect gross margin percentage to be in line or slightly better compared to the April 2017 quarterly margin, reflecting the expected mix of work activity and improving performance as services for large customer programs begin to accelerate.”

What Dycom failed to disclose, however was that its large projects were “highly dependent on permitting and tactical considerations,” and that it was “facing great uncertainties related to permitting issues,” and the resulting exposure to “near-term margin pressure and absorption issues.”

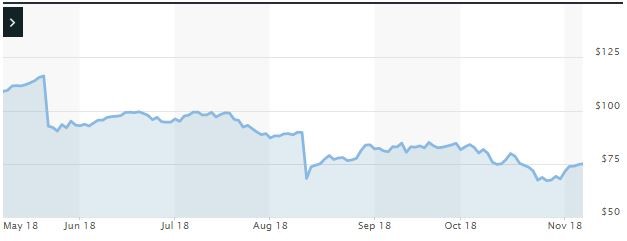

Impact of the Alleged Fraud on Dycom’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$89.71 |

| Closing stock price the trading day after disclosures:

|

$68.09 |

| One day stock price decrease (percentage) as a result of disclosures:

|

24.10% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is December 24, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.