Levi & Korsinsky Announce FCHS Lawsuit; FCHS Class Action

Levi & Korsinsky, LLP

April 29, 2019

Mas Partners LP v. First Choice Healthcare Solutions Inc., et al 6:19-cv-00619 — On March 29, 2019, investors sued First Choice Healthcare Solutions, Inc. (“First Choice,” “FCHS,” or the “Company”) in United States District Court, Middle District of Florida. Plaintiffs in the FCHS class action allege that they acquired First Choice stock at artificially inflated prices between April 1, 2014 and November 14, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the FCHS Lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, the Company (OTC: FCHS) engages in the development of a “network of localized, integrated care platforms comprised of non-physician-owned medical centers.”

The Company says these “medical centers of excellence” are specifically designed to meet the needs of patients requiring specialized treatment and care including that related to: orthopedics, spine surgery, neurology, interventional pain management and “related diagnostic and ancillary services.” The Company also notes that it targets important markets in the southeastern region of the United States for the development of such centers.

Finally, the Company says its “flagship integrated platform,” including First Choice Medical Group, The B.A.C.K. Center and Crane Creek Surgery Center, now facilitates more than 100,000 patient visits annually,

Summary of Facts

First Choice and its former CEO/president/chairman (collectively, the “Defendants”) are now accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about certain conduct and lack of compliance with internal policies from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused First Choice stock to trade at artificially inflated prices during the time in question.

The truth emerged in a series of events that transpired on November 14, 2018 and November 15, 2018. First, the U.S. Department of Justice (“DOJ”) filed an indictment against then-First Choice CEO Christian Romandetti, Sr., and several other participants in an alleged “pump and dump scheme.”

In a press release issued the next day (November 15), the DOJ announced the indictment and its charges against Romandetti “and his associates… with conducting a pump and dump scheme in coordination with Elite Stock Research (ESR), a boiler room, to defraud investors in FCHS… The charges include conspiracies to commit securities fraud, wire fraud and money laundering and substantive securities fraud.”

Also on November 15, the SEC filed a complaint and issued a press release announcing its charges “for defrauding elderly and unsophisticated investors.”

A closer look

As alleged in the March 29 complaint, the Defendants repeatedly made false and misleading public statements throughout the Class Period.

For example, signed certifications accompanying an Annual Report filed by the Company at the beginning of the Class Period stated that the Report: “did not contain any untrue statement of a material fact; or omit to state a material fact necessary to make the statements made, in light of the circumstances under which statements were made, not misleading with respect to the period covered by this report.”

Then, on another Annual Report filed with the SEC on April 15, 2015, the Company stated in pertinent part: “[the] market price of our common stock is likely to be similarly volatile, and investors in our common stock may experience a decrease, which could be substantial, in the value of their stock.”

Finally, on the same form, the Company stated in pertinent part: “On September 18, 2014, the Company entered into a cancelable 4-month agreement (the “Agreement”) to engage the services of Elite Stock Research, Inc.” However, as the March 29 complaint alleges, the Company did not reveal at the time that it had enlisted the “boiler room operation” to “engage in a pump and dump scheme.”

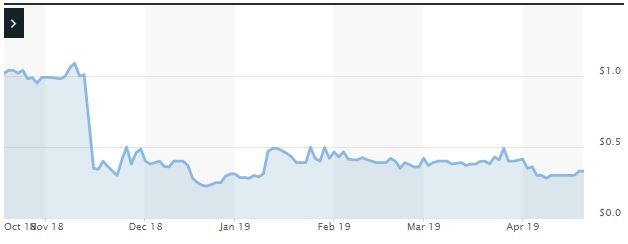

Impact of the Alleged Fraud on First Choice’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$1.01 |

| Closing stock price the trading day after disclosures:

|

$0.35 |

| One day stock price decrease (percentage) as a result of disclosures:

|

65.35% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in First Choice common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.