GDS Lawsuit: Levi & Korsinsky Announces GDS Holdings Class Action

Levi & Korsinsky, LLP

August 20, 2018

Allison v. GDS Holdings Limited, et al 1:18-cv-06960 — On August 2, 2018, investors sued GDS Holdings Limited (GDS or the Company) In United States District Court, Southern District of New York. Plaintiffs in the federal securities class action allege that they acquired GDS American Depositary Shares (ADS) at artificially inflated prices between November 2, 2016 and July 31, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the GDS Lawsuit, please click here.

Summary of the Allegations

Company Background

According to its website the Company (NASDAQ: GDS) is a “a leading developer and operator of high performance data centers in China.” As such, it says it has roughly 500 customers including “large Internet companies, financial institutions, telecommunications and IT service providers, and large domestic private sector and multinational corporations.”

GDS also says its facilities are “strategically located in China’s primary economic hubs where demand for high performance data center services is concentrated,” and that its data centers feature “large net floor area, high power capacity, density and efficiency, and multiple redundancy across all critical systems.”

As of last November, the Company says, it had “an aggregate net floor area over 101,000 sqm in service and an aggregate net floor area over 24,000 sqm under construction.”

Summary of Facts

GDS and two of its officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about its utilization and occupancy rates; its use of suspect capital and debt raisings; certain acquisitions; and certain accounting practices from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused the Company’s ADS to trade at artificially inflated prices during the time in question.

The truth emerged in a report published by Blue Orca on July 31, 2018. In it, Blue Orca revealed that GDS had allegedly engaged in fraud by overstating certain metrics for one of its “flagship data centers;’ by “inflating the purchase price of undisclosed related party acquisitions;” through questionable use of equity and debt raising; and through use of questionable accounting practices.

A closer look…

As alleged in the August 2 complaint, the Company and/or Individual Defendants repeatedly made false or misleading public statements during the Class Period.

For example, in a Prospectus filed with the SEC on November 2, 2016, the Company said in pertinent part: “Due to the lengthy time period required to build data centers and the long-term nature of these investments, if we overestimate market demand for data center resources, our utilization rates, which is the ratio of area utilized to area in service would be reduced, which would adversely affect our results of operations. Our revenue growth data depends on our ability to secure commitment s for our data center services.”

Then, in its 2016 Annual Report, filed with the SEC on April 19, 2017, GDS stated in pertinent part: “Our substantial level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations under our indebtedness.”

Finally, in its 2017 Annual Report, which was filed with the SEC on March 29, 2018, GDS said in relevant part: “We recently received the Registration Certificate of the Filing of Foreign Debt Borrowed by Enterprises, or the Foreign Debt Registration Certificate, issued by the National Development and Reform Commission, or the NDRC, permitting us to issue foreign currency denominated bonds of up to US$300 million…”

On the same report, the Company claimed that its Guangshou 1 data center [“GZI”] had a 90% utilization rate and a 100% commitment rate.”

Impact of the Alleged Fraud on GDS ADS Price and Market Capitalization

| Closing ADS price prior to disclosures:

|

$35.25 |

| Closing ADS price the trading day after disclosures:

|

$21.83 |

| One ADS price decrease (percentage) as a result of disclosures:

|

38.07% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is October 1, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in GDS ADS using court approved loss calculation methods.

Recently Filed Cases

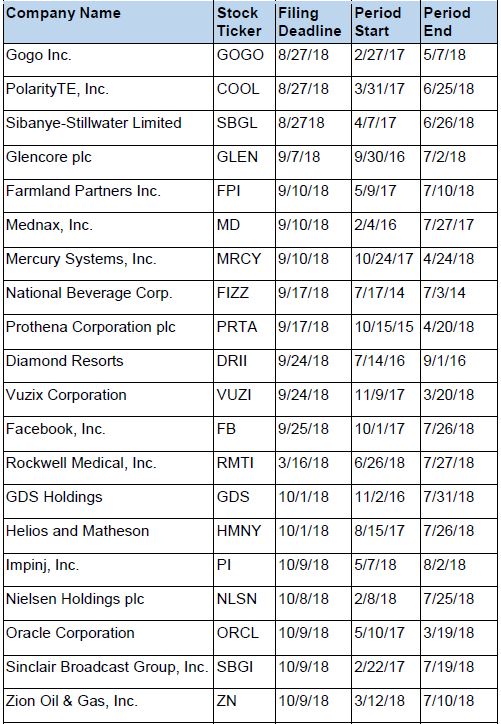

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.