Levi & Korsinsky Announce A HLTH Lawsuit; HLTH Class Action

Levi & Korsinsky, LLP

January 2, 2019

Van ‘t Hoofd v. Nobilis Health Corp. et al 4:18-cv-04727 — On December 14, 2018, investors sued Nobilis Health Corp. (“Nobilis” or the “Company”) in United States District Court for the Southern District of Texas, Houston Division. Plaintiffs in the HLTH class action allege that they acquired Nobilis stock at artificially inflated prices between May 8, 2018 and November 15, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the HLTH Lawsuit, contact us today!

Summary of the Allegations

Company Background

The Company (NYSE: HLTH) describes itself as a “recognized healthcare leader and marketing innovator.”

As such, Nobilis says it “develops, owns, and partners with ambulatory surgery centers, hospitals, and physician practices to provide high-yield procedures in the rapidly expanding, minimally invasive, elective surgery market.”

In all, the Company has more than 30 locations across Texas and Arizona. In addition to operating its own facilities, including hospitals, ambulatory surgery centers, and multi-specialty clinics in the desert southwest, Nobilis has also teamed up with 30 facilities in other parts of the country.

By marketing “nine independent brands,” Nobilis says it “deploys a unique patient acquisition strategy driven by proprietary, direct-to-consumer marketing technology, focusing on a specified set of procedures that are performed at its facilities by local physicians.”

Summary of Facts

The Company and three of its current and/or former senior officers (the “individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about business practices during the Class Period.

Specifically, they are accused of omitting truthful information about its revenue and accounts receivable from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Nobilis stock to trade at artificially inflated prices during the time in question.

The truth came out in a series of events between August 2, 2018 and November 15, 2018. On August 2, the Company reported, “that its revenue for the second quarter of 208 was reduced due, in part, to a $2.4 million adjustment to its accounts receivable.”

Then, on November 9, Nobilis reported that it is “re-evaluating the Net Realizable Value on its Accounts Receivable and intends to make a significant adjustment to the carrying value of accounts receivable, primarily on out of network claims greater than 365 days old.” The Company also “filed for additional time to file its 10-Q for the period ended September 30, 2018, while the Company and the auditor completed their review of the financial statements.”

Six days later, Nobilis announced that the NYSE had notified it that the Company “is not in compliance with the NYSE’s continued listing requirements due to its failure to timely file its 10-Q.”

A closer look…

As alleged in the December 14 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a press release issued at the beginning of the Class Period, the Company reported revenue of $64.5 million and accounts receivable was $133.4 million.” In the same press release, the Company also “provided full year 2018 guidance with revenue in the range of $345.0 million to $355.0 million and adjusted EBITDA in the range of $57.0 million to $62.0 million.”

Then, in a press release issued on August 2, 2018, the Company reported, “that a new accounting standard regarding accounts receivable had impacted revenue.” In the same press release, Nobilis revised its full year 2018 guidance with revenue in the range of $315.0 million to $330.0 million and adjusted EBITDA in the range of $56.0 million to $59.0 million.”

During a conference call also held on August 2, 2018, one of the Individual Defendants explained that, “due to the new accounting standard, all accounts receivable adjustments are recorded as reductions in revenue, rather than as bad debt expense as under the previous standard.”

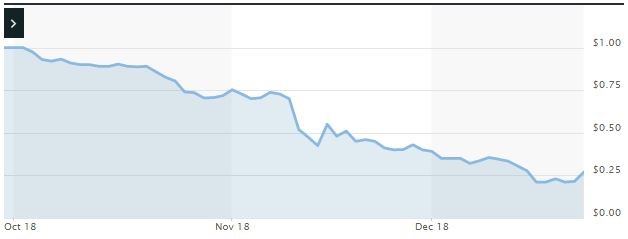

Impact of the Alleged Fraud on Nobilis’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$0.55 |

| Closing stock price the trading day after disclosures:

|

$0.48 |

| One day stock price decrease (percentage) as a result of disclosures:

|

12.73% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is February 12, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Nobilis common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.