Levi & Korsinsky Announces HON Class Action; HON Lawsuit

Levi & Korsinsky, LLP

November 26, 2018

Kanefsky v. Honeywell International, Inc., et al 2:18-cv-15536-WJM-MF — On October 31, 2018, investors sued Honeywell International, Inc., (“Honeywell” or the “Company”) In United States District Court for the District of New Jersey. The HON class action alleges that plaintiffs acquired Honeywell stock at artificially inflated prices between February 9, 2018 and October 19, 2018 (the “Class Period). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the HON lawsuit, please contact us today!

Summary of the Allegations

Company Background

As a “multi-national conglomerate,” Honeywell (NYSE: HON) engages in the manufacturing of numerous commercial and consumer products, engineering services and aerospace systems.

Its history dates to 1885, when inventor Albert Butz patented the “furnace regulator and alarm.” Butz established the Butz Thermo-Electric Regulator Co., Minneapolis, in April 1886. That business eventually became the Minneapolis Heat Regulator Company, which in turn merged with Honeywell Heating Specialty Co., in 1927.

Today, Honeywell is based in Morris Plains, New Jersey, and has operations at approximately 1,300 sites in 70 countries. It also has more than 131,000 employees globally, including more than 22,000 engineers and 11,000 software developers.

Of special relevance here is Honeywell’s ownership of Bendix Friction Metals (“Bendix”) until 2014. Bendix, which makes automotive, truck and industrial brakes, allegedly ignored known health hazards and used asbestos in its brake- and clutch-pad products until 2001.

Honeywell’s claims about its Bendix asbestos-related liability are at the crux of the October 31 complaint.

Summary of Facts

Honeywell and two of its officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and compliance policies during the Class Period.

Specifically, they are accused of omitting truthful information about certain liability and accounting practices from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Honeywell stock to trade at artificially inflated prices during the time in question.

The truth began to surface on August 23, 2018, when the Company revealed that its “Bendix asbestos-related liability is estimated to be $1,693 million [sic] as of June 30, 2018.” The Company also acknowledged that, “this is $1,083 [sic] million higher than the Company’s prior estimation.”

Then, in a quarterly report filed with the SEC on October 19, 2018, Honeywell disclosed that, “the SEC’s Division of Corporate Finance had reviewed Honeywell’s prior accounting for liability for unasserted Bendix-related asbestos claims…” The Company also revealed that it learned about the initiation of a related investigation by the SEC Division of Enforcement on September 13, 2018.

A closer look…

As alleged in the October 31 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements throughout the Class Period.

For instance, on a form filed with the SEC at the beginning of the Class Period, the Company stated in relevant part: “In connection with the recognition of liabilities for asbestos related matters, we record asbestos related insurance recoveries that are deemed probable.”

On another form filed with the SEC on April 20, 2018, Honeywell also said in relevant part: “We have valued Bendix pending and future claims using average resolution values for the previous five years.”

Finally, in a quarterly report filed with the SE on July 20, 2018, Honeywell reported that its asbestos related liabilities attributable to Bendix totaled $610 [sic] as of June 30, 2018.

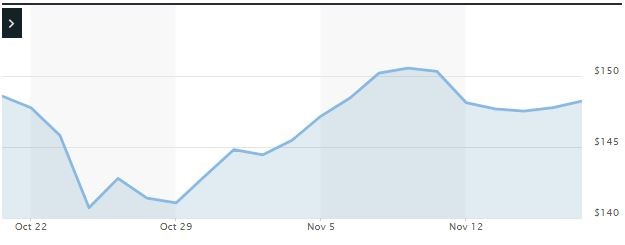

Impact of the Alleged Fraud on Honeywell’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$155.19 |

| Closing stock price the trading day after disclosures:

|

$153.47 |

| One day stock price decrease (percentage) as a result of disclosures:

|

1.11% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is December 31, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Honeywell common stock using court approved loss calculation methods.

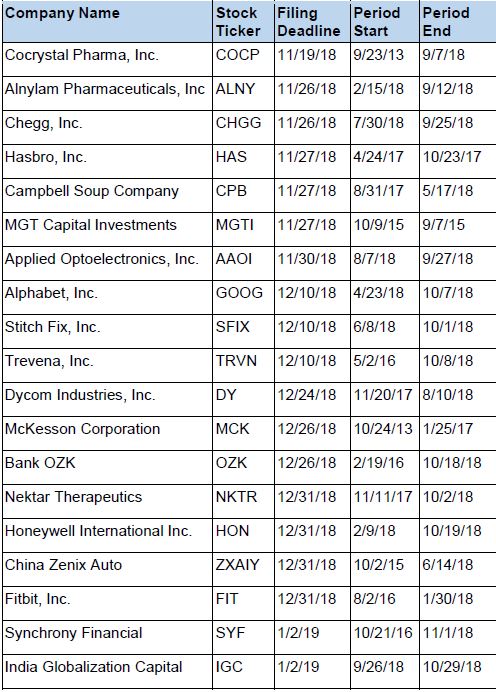

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.