HTHT Lawsuit; Levi & Korsinsky Announces HTHT Class Action

Levi & Korsinsky, LLP

October 18, 2018

Hayes v. Huazhu Group, Ltd., et al 2:18-cv-08633 — On October 1, 2018, investors sued Huazhu Group, Ltd., (“Huazhu” or the “Company”) in United States District Court, Central District of California. The HTHT class action alleges that plaintiffs acquired Huazhu’s American Depository Shares (ADSs) at artificially inflated prices between May 14, 2018 and August 28, 2018 (the “Class Period”). They are now seeking compensation for losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the HTHT lawsuit, please contact us today!

Summary of the Allegations

Company Background

Formerly known as the China Lodging Group, Ltd., Huazhu (NASDAQ: HTHT) is a self-described, “multi-brand hotel group in China.” As such, it is dedicated to providing its customers with “high quality and diverse accommodation and transportation experience.”

To this end, it offers a loyalty/rewards program and hotel-booking platform called “H Rewards” that also allows more than 100 million members to access more than 3,000 hotels in more than 300 cities around the world. The Company also says its associated APP has been downloaded more than 20 million times.

According to its website, Huazhu has been listed on the NASDAQ since 2010 and reached a “long-term strategic alliance with ACCOR Hotels Group four years later. In 2017, a trade publication recognized Huazhu as the ninth largest hotel group in the world.

Summary of Facts

Huazhu and its CEO (the “Individual Defendant”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about Huazhu’s ability to safeguard its customers’ information and related matters from its press releases. By knowingly or recklessly doing so, they allegedly caused the Company’s ADSs to trade at artificially inflated prices during the time in question.

The truth came out in media reports on August 28, 2018. That day, the media reported that, “Chinese police were investigating a possible leak of client information from Huazhu, stating that nearly 500 million pieces of customer-related information, including registration information, personal data and booking records, had emerged in an online post.”

A closer look…

As alleged in the October 1 complaint, the Company and/or Individual Defendant repeatedly made false and misleading public statements during the Class Period.

For example, in a May 14 press release announcing its first quarter 2018 financial results, the Company stated in pertinent part: “The Company provides guidance for Q2 2018 net revenues growth of 24%-26% year over year, and revises upward the full year net revenues growth estimate ranges from 16%-19% to 18%-22% accordingly.”

Then, in an August 22 press release announcing its second quarter 2018 financial results, the Company stated in relevant part: “The Company provides guidance for Q3 2018 net revenues growth of 10-5%-12.5% year over year, and maintains the full year net revenues growth estimate range of 18%-22%.”

What the Company failed to disclose, however, was that it “lacked adequate security measures to protect customer information,” and that this could heighten its litigation risk, resulting in increased expenses. The Company also failed to disclose the potential impacts on its goodwill, including lower revenues.

Impact of the Alleged Fraud on Huazhu’s ADS Price and Market Capitalization

| Closing ADS price prior to disclosures:

|

$35.53 |

| Closing ADS price the trading day after disclosures:

|

$33.98 |

| One day ADS price decrease (percentage) as a result of disclosures:

|

4.36% |

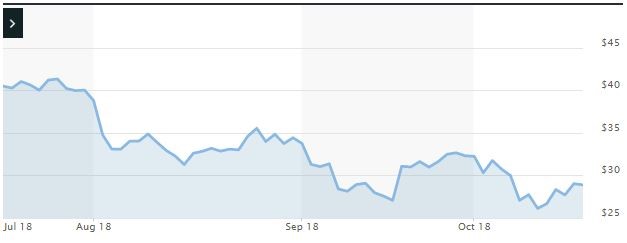

The following chart illustrates the ADS price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is December 7, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Huazhu ADSs using court approved loss calculation methods.

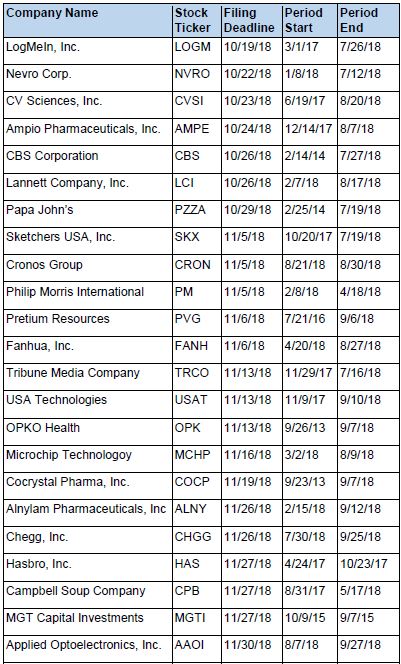

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.