Levi & Korsinsky Announces IGC Class Action; IGC Lawsuit

Levi & Korsinsky, LLP

November 27, 2018

Tchatchou v. India Globalization Capital, Inc., et al 8:18-cv-03396-PWG — On November 2, 2018, investors sued India Globalization Capital, Inc., (“IGC” or the “Company) in United States District Court for the District of Maryland. The federal securities class action alleges that the plaintiffs acquired IGC stock at artificially inflated prices between September 26, 2018 and October 29, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the IGC Lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, the Company (NYSE American: IGC) engages in two different types of businesses.

The first is a “Legacy Infrastructure” business mostly conducted through IGC’s subsidiary, TBL, which includes heavy equipment rental, real estate management and trading in certain commodities.

The second is IGCA Pharma. The Company describes this business as a “leading cannabis-based pharmaceutical company with a pipeline of products designed to improve the lives of patients battling Alzheimer’s Disease, Parkinson’s Disease, chronic pain, PTSD and eating disorders.”

IGC is incorporated and based in Maryland. According to the November 2 complaint, the Company had more than 31 million shares issued and outstanding as of June 15, 2018.

Summary of Facts

IGC and three of its officers and/or directors (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about certain “ventures and promotions,” from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused IGC stock to trade at artificially inflated prices during the time in question.

The truth began to emerge when Citron Research and Marketwatch publicly questioned IGC’s operations following the “astronomic rise of the Company’s stock price.”

Then, on October 29, 2018, when NYSE American announced that, “trading in the Company’s stock would be immediately suspended and delisted from the Exchange” for various reasons.

A closer look…

As alleged in the November 2 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, on September 25, 2018, the Company issued a press release announcing its plans to enter a partnership and launch a “hemp/CBD-infused energy drink” called Nitro-G. In it, IGC stated in relevant part: “IGC will pay 797,000 shares of restricted, unregistered, common stock, for a 10-year agreement, with an option for multiple 5-year extensions, for the rights to market the products in the U.S., Canada, Mexico and South America, and exclusive global rights to all developed CBD-infused products.”

In the same press release, the Company also said in pertinent part: “IGC plans to create a branded, hemp/CBD-infused version of the formulation that addresses market demand for energy drinks with the inclusion of healthy properties derived from hemp including CBD.”

Finally, in the same press release, the Company concluded: “This transaction is particularly timely given the language of the 2018 Farm Bill that currently addresses potentially legalizing, on a federal level, industrial hemp and products derived from it, including hemp oil that contains CBD.”

The November 2 complaint alleges that IGC’s stock “rocketed 458%” within the week following the announcement. That week, IGC also “conducted an at-the-market stock offering announced on September 22, 2018, raising $30 million in capital.”

What the Company never disclosed, however, was that it was “engaged in ventures or promotions which it had not developed to commercial stage,” and that its management had “engaged in operations contrary to public interest.”

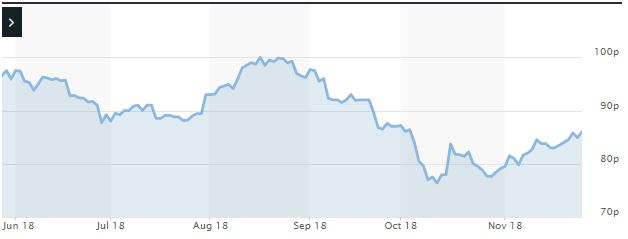

Impact of the Alleged Fraud on IGC’s Stock Price and Market Capitalization

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is January 2, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in IGC common stock using court approved loss calculation methods.

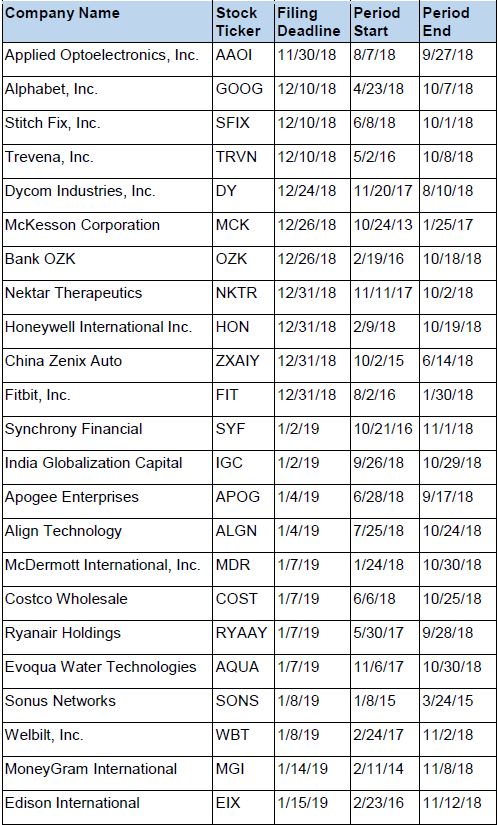

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.