Levi & Korsinsky Announces LXRX Lawsuit; LXRX Class Action

Levi & Korsinsky, LLP

February 22, 2019

Manopla v. Lexicon Pharmaceuticals Inc., et al 4:19-cv-00301 — On January 28, 2019, investors sued Lexicon Pharmaceuticals, Inc. (“Lexicon” or the “Company”) in United States District Court, Southern District of Texas, Houston Division. The LXRX class action alleges that plaintiffs acquired Lexicon stock at artificially inflated prices between March 11, 2016 and January 17, 2019 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the LXRX lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Company (NASDAQ: LXRX) is a self-described “fully integrated biopharmaceutical company.”

As such, Lexicon says it “is applying a unique approach to gene science based on Nobel Prize-winning technology to discover and develop precise medicines for people with serious, chronic conditions.”

As detailed in the January 28 complaint, Lexicon teamed up with Sanofi S.A. (“Sanofi”), a French multinational pharmaceutical company, in November 2015. The Company did so to further the global development, promotion and commercialization of one of its “orally-delivered small molecule drug candidates.”

The deal granted Sanofi “exclusive, worldwide royalty-bearing rights and license to develop, manufacture and commercialize Sotagliflozin.” Meanwhile, Lexicon, which is “responsible for all clinical development activities relating to type 1 diabetes,” retained “an exclusive option to co-promote and have a significant role, in collaboration with Sanofi, in the commercialization of Sotagliflozin for the treatment of type 1 diabetes in the United States.”

Claims made about Sotagliflozin, which was renamed Zynquista for commercial purposes, are at the crux of the January 28 complaint.

Summary of Facts

Lexicon and two of its senior officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business and compliance practices during the Class Period.

Specifically, they are accused of omitting truthful information about the safety and efficacy of Sotagliflozin from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Lexicon stock to trade at artificially inflated prices during the time in question.

The truth came out in a series of events that transpired between on January 17 and January 18, 2019. First, Lexicon announced that, “the Advisory Committee had ‘voted eight to eight on the question of whether the overall benefits of [Lexicon’s product] Zynquista (Sotagliflozin) outweighed the risks to support approval…’”

Then, in a Motley Fool article detailing the FDA Advisory Committee’s deadlock published the next day raised additional concerns, saying in pertinent part: “The impasse means investors have no way of knowing the path forward for the drug candidate.”

A closer look…

As alleged in the January 28 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For instance, in an annual report filed with the SEC at the beginning of the Class Period, the Company stated in pertinent part: “ Data from the [Phase 2] study showed that treatment with sotagliflozin demonstrated statistically significant benefits in the primary and multiple secondary endpoints.”

Then, in another annual report filed with the SEC on March 6, 2017, Lexicon also said that it had “reported positive top-line primary efficacy endpoint data from two pivotal Phase 3 clinical trials of sotagliflozin in type 1 diabetes patients.”

Finally, in another annual report filed with the SEC on March 1, 2018, Lexicon used only generic language to describe the “risk that an NDA [New Drug Application] could fail to meet FDA regulatory hurdles, saying: “There can be no assurance that the FDA will accept an NDA for filing and, even if accepted for filing, that approval will be granted.”

Impact of the Alleged Fraud on Lexicon’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$7.70 |

| Closing stock price the trading day after disclosures:

|

$5.96 |

| One day stock price decrease (percentage) as a result of disclosures:

|

22.59% |

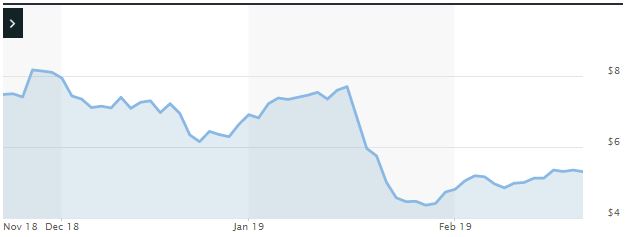

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Lexicon common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.