MGTI Lawsuit; Levi & Korsinsky Announces MGTI Class Action

Levi & Korsinsky, LLP

October 10, 2018

Klingberg v. MGT Capital Investments, Inc., et al 2:18-cv-14380-WHW-CLW–On September 28, 2018, investors sued MGT Capital Investments, Inc. (“MGT Capital” or the “Company”) in United States District Court, District of New Jersey. Plaintiffs in the MGTI class action allege that they acquired MGT Capital stock at artificially inflated prices between October 9, 2015 and September 7, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the MGTI Lawsuit, please contact us today.

Summary of the Allegations

Company Background

The Company (OTC:MGTI) and formerly (NYSE:MGT) is now engaged in bitcoin mining, a process in which “miners purchase powerful computing chips designed solely to solve the blocks which reward Bitcoins.”

According to its website, MGT Capital established its first facility and began bitcoin mining in Washington State in September 2016. As the result of a search for another location in 2017, MGT Capital opened its second bitcoin mining facility in northern Sweden. The Company claims that facility is large enough to house thousands of the “computing chips” which are essential to its operations.

In its prior iteration (from 2013 to 2016), the Company said, it was primarily “engaged in the business of acquiring, developing and monetizing assets in the online and mobile gaming space as well as the social casino industry.”

According to the September 28 complaint, MGT “announced it was transforming itself into a cyber security company” in May 2016.

Summary of Facts

MGT Capital, four of its current and former officers and or directors, and four shareholders (collectively the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about MGT Capital’s participation in certain activities and the consequences of said participation from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused MGT Capital stock to trade at artificially inflated prices during the time in question.

The truth surfaced in a series of events transpiring between September 19, 2016 and September 7, 2018. The most significant of the developments in the fall of 2016 was an October 19 press release issued by the NYSE MKT shortly before the market closed. It revealed that, “the staff of NYSE Regulation has determined to commence proceedings to delist the common stock of MGT Capital Investments, Inc., …from the Exchange. Trading in the Company’s common stock on the NYSE MKT will be suspended immediately.”

In the most recent development, the SEC issued a press release in which it announced that it charged several entities and individuals involved in “lucrative market manipulation schemes.” Of relevance here is that six of the defendants named in that case also have ties to MGT Capital.

A closer look…

As alleged in the September 28 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements throughout the Class Period.

For example, on a form filed with the SEC on April 20, 2017, the Company acknowledged that its stock price was “subject to volatility, but it failed to disclose it was being manipulated.”

The Company also failed to disclose that it was being manipulated on another form filed with the SEC on April 2, 2018. Instead, it again addressed the potential volatility of its stock price saying: “The market price of our Common Stock could change in ways that may or may not be related to our business, our industry or our operating performance and financial condition and could negatively affect our share price ore result in fluctuations in the price or trading volume of our Common Stock.”

Along with that form, the Company filed certifications signed by two of the Individual Defendants “attesting to the accuracy of financial reporting, the disclosure of any material changes to the Company’s internal control over financial reporting and disclosure of all fraud.”

Impact of the Alleged Fraud on MGT Capital’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$0.59 |

| Closing stock two trading days after disclosures:

|

$0.395 |

| Two day stock price decrease (percentage) as a result of disclosures:

|

33.05% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is November 27, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in MGT Capital common stock using court approved loss calculation methods.

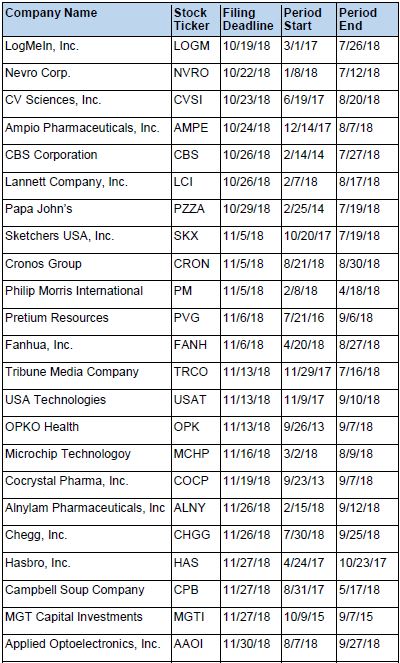

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.