MYGM Class Action Lawsuit Litigation Report

Levi & Korsinsky, LLP

April 26, 2018

On April 20, 2018, a securities class action lawsuit was brought against Myriad Genetics, Inc. (“Myriad” or the “Company”) in United States District Court, District of Utah. Investors in the federal securities class action allege that they acquired Myriad stock at artificially inflated prices between August 13, 2014 and March 12, 2018 (the “Class Period”). They are seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. Here’s what you need to know about the Myriad Genetics class action lawsuit (MYGM class action):

Summary of the Allegations

Company Background

The Company (NASDAQ: MYGM) is engaged in the development and marketing of diagnostic products used as tools in patient care and the prevention of certain diseases. Its products are also used to delay the onset of certain diseases and identifying them early on.

To that end, Myriad claims that it uses a number of exclusive techniques “designed to provide an understanding of the genetic basis of disease and the role of genes in the onset, progression and treatment of disease.”

Founded in 1991, the Company says it since developed the first molecular diagnostic test for breast cancer and the first genetic prognostic test for prostate cancer patients. In 2013, Myriad introduced three new products for use in the diagnosis and treatment of certain cancers.

Summary of Facts

Myriad and four of its current and former officers and or directors are now accused of deceiving investors by lying or withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about some of its billing practices for its hereditary cancer testing from SEC filings and related materials. By knowingly or recklessly doing so, they allegedly caused Myriad stock to trade at artificially inflated prices during the time in question.

The truth came out after the market closed on March12, 2018. That’s when Myriad revealed that it had been subpoenaed by the Department of Health and Human Services, Office of the Inspector General, in connection with “an investigation into possible false or otherwise improper claims submitted for payment under Medicare and Medicaid,” that was specifically related to its hereditary cancer testing.

According to the April 20 complaint, the subpoena covers “a time period from January 1, 2014 – less than four months after the September 2013 launch of Myriad’s myRisk test – through the date of the subpoena’s issuance.”

A closer look…

As alleged in the current lawsuit, Myriad repeatedly made false and misleading public statements during the Class Period.

For example, on a form filed with the SEC on August 13, 2014, the Company included vague statements about its compliance with certain rules and regulations, saying in pertinent part: “A variety of federal laws prohibit fraud and abuse involving state and federal health care programs, such as Medicare and Medicaid. These laws are interpreted broadly and enforced aggressively by various state and federal agencies…”

Another form filed with the SEC on May 6, 2015, included “signed certifications” by two of the individual defendants stating that: the form “does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report.”

Finally, on yet another form filed with the SEC on August 9, 2017, the Company stated in pertinent part: “[w]e believe the global market for myRisk Hereditary Cancer and all of our hereditary cancer tests is $5 billion annually.”

In reality, however, the Company was allegedly submitting “false or otherwise improper claims for payment under Medicare and Medicaid for the Company’s hereditary cancer testing.” As a result, Myriad’s revenues from its hereditary cancer testing were “in part the product of improper conduct and unlikely to be sustainable.”

Impact of the Alleged Fraud on Myriad’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$33.02 |

| Closing stock price the trading day after disclosures:

|

$29.01 |

| One day stock price decrease (percentage) as a result of disclosures:

|

12.14% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is June 19, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Myriad common stock using court approved loss calculation methods.

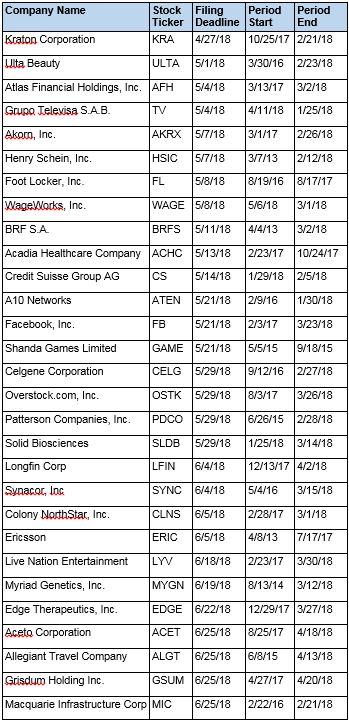

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

| This information is provided for general information purposes only, and should not be construed as legal advice, nor does it establish an attorney-client relationship with Levi & Korsinsky LLP. Any and all information herein is simply an opinion based on publicly available information and should not necessarily be construed as fact. For more information, please visit our website at www.zlk.com.

Attorney Advertising

|

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.