Levi & Korsinsky Announce NIO Lawsuit; NIO Class Action

Levi & Korsinsky, LLP

April 10, 2019

Tan v. NIO Inc., et al 1:19-cv-01424-NGG-VMS — On March 12, 2019, investors sued NIO, Inc., (“NIO” or the “Company”) in United States District Court, Eastern District of New York. The NIO class action alleges that plaintiffs acquired NIO’s American Depositary Shares (ADS) at the artificially inflated prices between September 12, 2018, and March 5, 2019 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the NIO Lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, the Company (NYSE: NIO) is a “pioneer in China’s premium electric vehicle market.” As such, NIO claims that it designs, co-manufactures, and sells “smart and connected premium electric vehicles…”

NIO says it introduced its first model, the EP9 supercar, three years ago and that it introduced “first volume manufactured electric vehicle, the ES8” to the public on December 16, 2017. NIO claims it started delivering the ES8 on Jun 28, 2018.

The Company also claims that it sells its vehicles “through our own sales network, including NIO Houses and our mobile application.”

NIO’s website indicates that the Company has offices in London, Munich, Shanghai, San Jose, California and “eight other locations. More than 500 people purportedly work at NIO’s North American headquarters and “global software development center,” in San Jose.

Summary of Facts

NIO and two of its senior officers (the “Individual Defendants”) now stand accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices, operational and financial results during the Class Period.

Specifically, they are accused of omitting truthful information about certain plans reductions in government subsidies for electric cars from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused NIO’s ADS to trade at artificially inflated prices during the time in question.

The truth came out after the market closed on March 5, 2019. That’s when the Company released its earnings report for the fourth quarter of 2018 and disclosed that it would “be terminating its agreement with the Shanghai government to build its own manufacturing plant in Shanghai, and instead continue to contract with JAC Auto to build its cars.”

The Company also disclosed reductions in the deliveries of its electric vehicles between December 2018 and February 2019. At the time, the Company attributed the decline to “anticipation of subsidy reductions for electric vehicles in 2019.”

A closer look…

As alleged in the March 12 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a Registration Statement filed with the SEC at the beginning of the Class Period, the Company stated that it is “developing our own manufacturing facility in Shanghai which we expect to be ready by the end of 2020.”

On the same Registration Statement, NIO also said that having its own manufacturing plant would allow it to “expand its manufacturing capability for the ET7 and future models,” and facilitate is ability to acquire its own Electric Vehicle manufacturing license.

Finally, during a conference call with analysts on November 11, 2018, one of the Individual Defendants addressed concerns about the anticipated reduction in government subsidies for electric vehicles. In this context he stated in pertinent part: “Of course, the subsidy in the next year will decrease. And we think this is not going to affect our gross margin that much because the sales price already includes the subsidy and this will not affect us that much.”

Impact of the Alleged Fraud on NIO’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$10.16 |

| Closing stock price the trading day after disclosures:

|

$7.09 |

| One day stock price decrease (percentage) as a result of disclosures:

|

30.22% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is May 13, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in NIO common stock using court approved loss calculation methods.

Recently Filed Cases

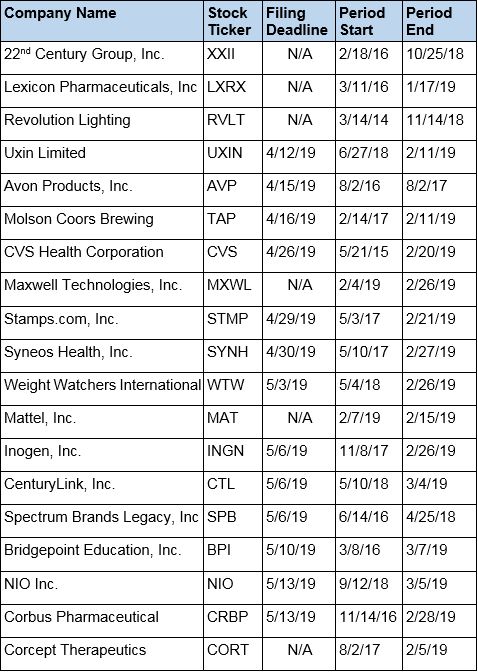

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.