Levi & Korsinsky Announces NVDA Lawsuit; NVDA Class Action

Levi & Korsinsky, LLP

January 17, 2019

Case Introduction Iron Workers Local 580 Joint Funds v. NVIDIA Corporation et al 1:18-cv-7669 — On December 21, 2018, investors sued NVIDIA Corporation (“NVIDIA” or the “Company”) in United States District Court, Northern District of California. Plaintiffs in the NVDA class action allege that they acquired NVIDIA stock at artificially inflated prices between August 10, 2017 and November 15, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the NVDA lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Company (NASDAQ: NVDA) is engaged in the design, development and marketing of graphics processing units (“GPUs”) and ancillary software. In this capacity, NVIDIA provides GPUs for uses ranging from computer gaming to cryptocurrency mining.

NVIDIA’s history dates to 1993. Within two years, the Company formed its first meaningful partnership and launched its first product. However, 1999 proved to be the most significant year in the young Company’s history as it “invented” the GPU, and introduced the QUADRO GPU for professional graphics. In that same year, it announced its initial public offering at $12 per share.

According to the December 21 complaint, there were more than 600 million NVIDIA shares, held by “at least hundreds or thousands of investors” outstanding as of November 9, 2018.

Summary of Facts

NVIDIA and two of its senior officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about revenue growth and NVIDIA’s ability to adapt to changes in cryptocurrency markets from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused NVIDIA stock to trade at artificially inflated prices during the time in question.

The truth came out in a series of events that transpired on August 16, 2018 and November 15, 2018. First, the Company “lowered its revenue guidance by about 2.2% for the third quarter of 2018 and reported that it no longer expects a meaningful contribution from cryptocurrency miners for the reminder of the year.” On the same day, NVIDIA also reported that, “its GPU inventory had ballooned by over 30% from the prior quarter, which investors feared could be a sign of slowing demand” for its GPUs.

Then, on November 15, 2018, the Company “significantly cuts its revenue guidance for the fiscal fourth quarter, revealing that revenue would actually decline by over 7%in the quarter – a significant departure from the 17% growth investors had been led to expect.” At the time, the Company attributed the disappointing results to “surging inventory of midrange GPUs that built up before the rapid fade of cryptocurrency mining,” which resulted in greater scrutiny and criticism from analysts.

A closer look…

As alleged in the December 21 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For instance, in a press release issued at the beginning of the Class Period, one of the Individual Defendants attributed revenue growth in the second fiscal quarter of 2017 to several factors. These included dramatic increases in data center revenue; the use of NVIDIA’s DRIVE PX self-driving computing platform by “a growing number of car and robot-taxi companies”; and growth of gaming platforms powered by the Company’s GPUs.”

Then on a conference call with analysts and investors held on November 9, 2017, one of the Individual Defendants “downplayed the importance of cryptocurrency mining on NVIDIA’s growth,” saying in pertinent part: “when you think about crypto in the context of our company overall, the thing to remember is that we’re the largest GPU computing company in the world. And our overall GPU business is really sizable and we have multiple segments.”

Finally, at an industry conference held February 26, 2018, one of the Individual Defendants “also continued to assure investors that cryptocurrency minders would not impact sales of GPUs to gaming customers, stating in relevant part: “we do believe we can serve [cryptocurrency miners] primarily with those specialized cards and that’s going to be our goal going forward.” Within this context, the same person added: “we’re going to really try our hardest to really focus our overall GPUs for gaming for overall gamers going forward.”

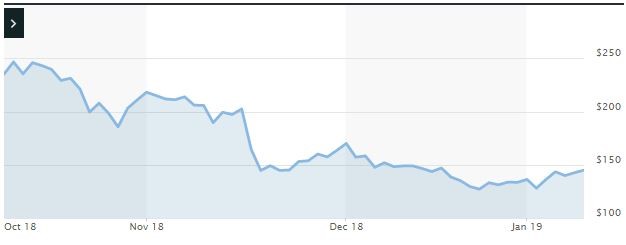

Impact of the Alleged Fraud on NVIDIA’s Stock Price and Market Capitalization

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is February 19, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in NVIDIA common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.