Levi & Korsinsky Announced RYAAY Lawsuit; RYAAY Class Action

Levi & Korsinsky, LLP

December 12, 2018

City of Birmingham Firemen’s and Policemen’s Supplemental Pension System v. Ryanair Holdings, plc. et al 1:18-cv-10330-JPO — On November 6, 2018, investors sued Ryanair Holdings, plc. (“Ryanair” or the “Company”) in United States District Court, Southern District of New York. Plaintiffs in the RYAAY class action allege that they acquired Ryanair American Depositary Shares (ADS) at artificially inflated prices between May 30, 2017, and September 28, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more on the RYAAY lawsuit, please contact us today.

Summary of the Allegations

Company Background

Ryanair (NASDAQ: RYAAY) is a commercial airline based in Dublin, Ireland.

According to its website, the Company’s history dates to 1985-1986, when it launched its “first route in July with daily flights on a 15-seater Bandeirante aircraft, operating daily from Waterford in the southeast of Ireland to London Gatwick.”

Today, the Company bills itself as, “Europe’s first and largest low fares airline,” and “Europe’s Number 1 airline.” Specifically, it claims that it accommodates more than 130 million passengers per year on “more than 2,000 daily flights from 86 bases, connecting 215 destinations in 37 countries on a fleet of 430 Boeing 737 aircraft.” Finally, the Company claims that it employs “a team of more than 14,500 highly skilled aviation professionals.”

Summary of Facts

Ryanair and its CEO now stand accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about difficult labor relations, and the potential impact on Ryanair’s operations and financial results, from SEC filings and related material. By recklessly or knowingly doing so, they allegedly caused Ryanair ADS to trade at artificially inflated prices during the time in question.

The truth came out in a series of events beginning on September 14, 2017. That’s when the public learned that Ryanair “had lost a key ruling in the European Court of Justice (“ECJ”) that cast doubt on the legality of the Company’s use of Irish employment contracts to evade local labor laws throughout Europe.”

The next day, the Company announced the short-term cancellation of daily flights affecting more than 300,000 customers due to “pilot scheduling issues.” However, reports quickly surfaced indicating that the disruption was really due to “widespread defections by disgruntled employees.”

Although the Company vowed to address employee concerns, news about ongoing employee unrest again surfaced in the summer of 2018. On July 23, 2018, the Company “disclosed a 20% decrease in quarterly profits, due in part to a 34% increase in staff costs.”

Finally, on October 1, 2018, Ryanair announced that it would be unable to meet its annual profit guidance “due to the lost fares and ballooning costs related to the strikes and flight cancellations.”

A closer look…

As alleged in the November 6 complaint, Ryanair and its CEO repeatedly made false and misleading public statements during the Class Period.

For example, on a form filed at the beginning of the Class Period, the Company stated in pertinent part: “In April we negotiated new pay and condition agreements with 10 of our pilot and cabin crew bases which means that all of our 86 bases now enjoy 5 year agreements, which guarantee them industry leading rosters, and pay increases each year.”

On a conference call with analysts and investors also held on May 30, 2017, Ryanair’s CEO said in relevant part: “We reject some of the idiotic criticism that came out of some Scandinavian pension forums recently that somehow we don’t deal with our employees, our employees are not covered by collective bargaining when they are. And we do not see unionization being an issue for the foreseeable future.”

Then on a form filed with the SEC on July 25, 2017, the Company stated in pertinent part: “Following negotiations through this ERC system, pilots of all of Ryanair’s 86 bases are covered by four, five or six year collective agreements on pay, allowances and rosters which fall due for negotiation at various dates between 2018 and 2023. Cabin crew at all of Ryanair’s bases are also party to long term collective agreements on pay, allowances and rosters, which expire in March 2021.”

Impact of the Alleged Fraud on Ryanair’s ADS Price and Market Capitalization

| Closing ADS price prior to disclosures:

|

$96.04 |

| Closing ADS price the trading day after disclosures:

|

$80.93 |

| One day stock price decrease (percentage) as a result of disclosures:

|

15.73% |

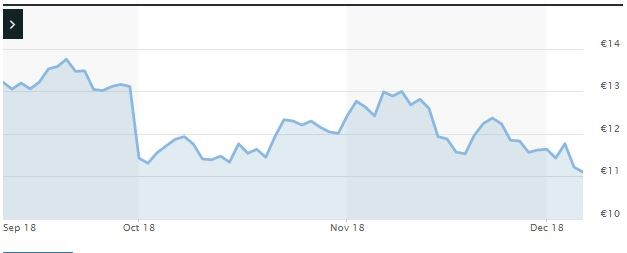

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is January 7, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Ryanair ADS using court-approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.