SBGI Lawsuit: Levi & Korsinsky Announces SBGI Class Action

Levi & Korsinsky, LLP

August 20, 2018

Komito v. Sinclair Broadcast Group, Inc. et al 1:18-cv-02445-CCB — On August 9, 2018, investors sued Sinclair Broadcast Group, Inc. (“Sinclair” or the “Company”) in United States District Court For The District of Maryland. Plaintiffs in the SBGI class action allege that they acquired Sinclair stock at artificially inflated prices between February 22, 2017 and July 19, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the SBGI lawsuit, please contact us today.

Summary of the Allegations

Company Background

According to its website, Sinclair (NASDAQ: SBGI) is “one of the largest and most diversified television broadcasting companies” in the United States.

As such it owns “a multicast network, four radio stations and a cable network.” In all it has 192 TV stations and 611 channels in 89 U.S. markets.

Sinclair’s history dates to 1986, when family patriarch Julian Sinclair Smith and his four sons (David, Fred, Duncan and Rob) consolidated the operations of what were then three independent UHF television stations in Baltimore, Pittsburgh and Columbus under Sinclair, and appointed their long-term partner, Robert “Bob” Simmons as the Company’s first President and CEO.

In the following decade, the Company experienced tremendous growth, expanding from three television stations to 59, thereby establishing itself as the largest broadcaster in the country.

Summary of Facts

Sinclair and two of its senior officers and/or directors (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they stand accused of omitting truthful information about certain transactions, its compliance with relevant FCC rules and regulations, and related matters from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Sinclair stock to trade at artificially inflated prices during the time in question.

The truth emerged on July 16, 2018, when “news reports disclosed that FCC Chairman Ajt Pai was circulating a draft Hearing Designation Order (‘HDO”) sending the Sinclair/Tribune deal to a hearing before the FCC’s administrative law judge, a process widely considered to be a death sentence for merger approvals.”

According to the August 9 complaint, the “draft HDO, seen by Reuters on July 16, 2018, stated that Chairman Pai had ‘serious concerns’ about the proposed merger, finding that ‘Sinclair’s actions here potentially involve deception.’”

With a unanimous vote after the market closed on July 18, 2018, the FCC sent the proposed merger to a hearing in spite of the Company’s attempt to convince it not to do so.

A closer look…

As alleged in the August 9 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For instance, when responding to a question about the potential for any “transformative” merger deals during an earnings call with investors on February 22, 2017, one of the Individual Defendants said in pertinent part: “So we have to wait and see what will happen, but we think it will actually happen fairly quickly here and we’ll start to see some movement this year. And if that happens, I do expect transformative deals to come on the heels of that.”

In a May 8, 2017 press release announcing the Company’s merger with Tribune, the Company said in pertinent part: “In order to comply with FCC ownership requirements and antitrust regulations, Sinclair may sell certain stations in market where it currently owns stations. Such divestitures will be determined through the regulatory process.”

Then on a Registration Statement in connection with the merger that was filed with the SEC on July 3, 2017, Sinclair said in relevant part: “Sinclair also agreed, subject to the terms of the agreement, to use reasonable best efforts to take all actions to avoid or eliminate any impediment that may be asserted by a governmental authority with respect to the transactions…”

Impact of the Alleged Fraud on Sinclair’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$27.40 |

| Closing stock price the trading day after disclosures:

|

$26.30 |

| One day stock price decrease (percentage) as a result of disclosures:

|

4.01% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is October 9, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Sinclair common stock using court approved loss calculation methods.

Recently Filed Cases

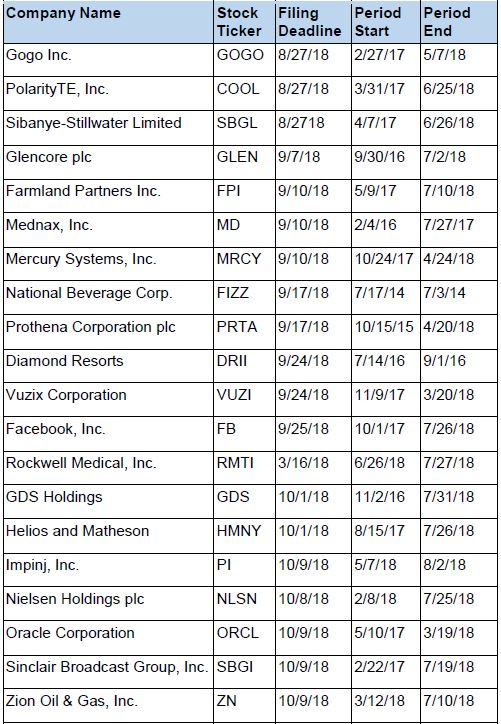

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.