SFIX Lawsuit; SFIX Class Action Announced by Levi & Korsinsky

Levi & Korsinsky, LLP

October 24, 2018

Sawicki v. Stitch Fix, Inc., et al 3:18-cv-06208-JD — On October 11, 2018, investors sued Stitch Fix, Inc. (“Stitch Fix” or the “Company”) in United States District Court, Northern District of California. Plaintiffs in the SFIX class action allege that they acquired Stich Fix stock at artificially inflated prices between June 8, 2018 and October 1, 2018). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the SFIX lawsuit, please contact us today.

Summary of the Allegations

Company Background

The Company (NASDAQ: SFIX) is a self-described “personal style service for men and women that evolves with your tastes, needs and lifestyle.”

Here’s how it works. Users visit the Company’s website, where they provide information about the types of clothes they like, the sizes they need, and their budgets on forms called “Style Profiles.” The customers then choose when they would like to get their package(s) and pay a specified fee, which is “applied as a credit” toward anything they keep from the shipment. Once they receive their shipment(s), customers have three days in which to decide what to keep and what to return (if anything). Customers are only charged once they “check out” on the Company’s website or app, and those who choose to keep everything receive a significant discount.

The Company’s claims about the number and growth rate of its “active clients” are at the crux of the October 11 complaint.

Summary of Facts

Stitch Fix and three of its officers (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about its “active clients” and commitment to TV advertising from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Stitch Fix stock to trade at artificially inflated prices during the time in question.

The truth emerged when the Company announced its financial results for the fourth quarter of 2018 after the market closed on October 1, 2018. Stich Fix then admitted that it had, “signed up far fewer than expected new active clients during 4Q2018, which had ended more than two months earlier, on July 28, 2018.” The Company also “shocked the market by disclosing that Stitch Fix’s active client count was virtually flat, coming in at 2.7 million.”

A closer look…

As alleged in the October 11 complaint, Stitch Fix and/or the Individual defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a press release issued at the beginning of the Class Period, one of the Individual Defendants said in pertinent part: “Our third quarter results demonstrate continued positive momentum for Stitch Fix and the power of our unique ability to deliver personalized service at scale.”

In a letter to shareholders also issued and filed with the SEC at the beginning of the Class Period, the Company reiterated claims that it had “[grown] active clients to 2.7 million as of April 28, 2018,” from 2.5 million in 2.5 million in the previous quarter of 2018, and from 2.07 million from the same period in 2017, reflecting “an increase of 614,000 and 29.6% year-over-year growth.”

On a form filed with the SEC on June 8, 2018, the Company specifically addressed its active client growth, saying in relevant part: “We believe that the number of active clients is a key indicator of our growth and the overall health of our business.”

On the same form, Stitch Fix discussed its marketing, saying in relevant part: “As our business has achieved a greater scale and we are able to support a large and growing client base, we have increased our investments in marketing to take advantage of more marketing channels to profitably acquire clients. Our current marketing efforts include client referrals, affiliate programs, partnerships, display advertising, television, print, radio, video, content, direct mail, social media, email, mobile ‘push’ communications, search engine optimization and keyword search campaigns.”

Impact of the Alleged Fraud on Stitch Fix’s Stock Price and Market Capitalization

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is December 10, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Stitch Fix common stock using court approved loss calculation methods.

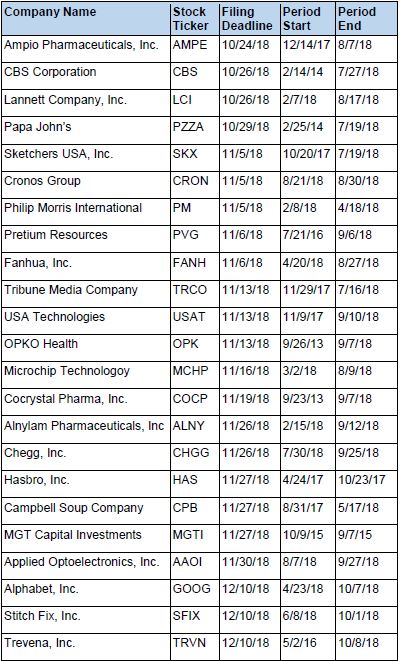

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.