SONS Class Action (RBBN Class Action Lawsuit) Filed; SONS Lawsuit

Levi & Korsinsky, LLP

November 27, 2018

Miller v. Sonus Networks, Inc., et al 1:18-cv-12344 — On November 8, 2018, investors sued Sonus Networks, Inc., (“Sonus” or the “Company”) in United States District Court, District of Massachusetts. The SONS class action (RBBN Class Action) alleges that plaintiffs acquired Sonus stock at artificially inflated prices between January 8, 2015, and March 24, 2015 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the SONS Lawsuit (RBBN Lawsuit), please contact us today!

Summary of the Allegations

Company Background

Now known as Ribbon Communications, Inc. (NASDAQ: RBBN), Sonus (formerly NASDAQ: SONS), has been in business since 1997 and engages in the provision of “communications solutions.”

The technology the Company offers allows service providers and other establishments to safeguard their “communications infrastructures” through the use of Voice over Internet Protocol (“VoIP”), video, instant messaging and online collaboration.

According to the November 8 complaint, Sonus “began shifting its product line” as “IP-to-IP communications have become more common.” Specifically, it transitioned to the provision of “cloud-based solutions to link and secure multivendor, multiprotocol communications systems and applications across their customers’ networks of smartphones and tablets, for all of their employees and all of their offices.” Within this context, it focused on the production of “session border controllers,” or “SBCs.” SBCs are important because they “help secure connections as private communications connect with the public internet [sic].”

As technology and resulting demands for security have grown and changed, Sonus has also transitioned to the production of “diameter signaling controllers,” or “DSCs.” These products serve a crucial purpose by interconnecting separate elements and creating “a central point of control” within 4G LTE networks.

A “global direct sales force” sells the Company’s products. It is supplemented by “sales support from regional channel partners” worldwide.

Summary of Facts

Sonus and three of its former officers and/or senior executives (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about the Company’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about certain revenue from SEC filings and related material. By knowingly and deliberately doing so, they allegedly caused Sonus stock to trade at artificially inflated prices during the time in question.

The truth began to surface when the Company issued a press release before the market opened on March 24, 2015. In it, Sonus revealed that it had missed its first quarter, 2015 revenue projection by more than $20 million. According to the November 8 complaint, the Company’s only explanation at the time was that it, “no longer expects to receive certain orders this quarter that had been expected to be received at the back end of the first quarter.”

Immediately following the revelation, one industry analyst reduced the Company’s stock rating. The next day, another analyst blasted Sonus for its lack of honesty and management’s failure to provide any explanation for the reduced guidance.

Finally, on August 7, 2018, the SEC issued a press release and an Order. In it, the SEC announced that it had charged Ribbon Communications, Inc., and two of the Individual Defendants with making “material misstatements” about Sonus’s “revenue statements and guidance for Q1 2015” on January 8, 2015, and February 18, 2015. In settling the charges, the Company and Individual Defendants “agreed to pay civil penalties totaling $1.97 million.”

A closer look…

As alleged in the November 8 complaint, Sonus and/or the Individual Defendants repeatedly made misleading public statements during the Class Period.

For example, in a press release issued at the beginning of the Class Period, one of the Individual Defendants said in pertinent part: “We remain comfortable with consensus analyst revenue… estimates for the first quarter of 2015 of approximately $74 million.”

Then, during an earnings call held on February 18, 2015, the same Individual Defendant also said in relevant part: “Now, looking at Q1, we expect revenue to be approximately $74 million.”

Impact of the Alleged Fraud on Sonus’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$13.16 |

| Closing stock price the trading day after disclosures:

|

$8.70 |

| One day stock price decrease (percentage) as a result of disclosures:

|

33.89% |

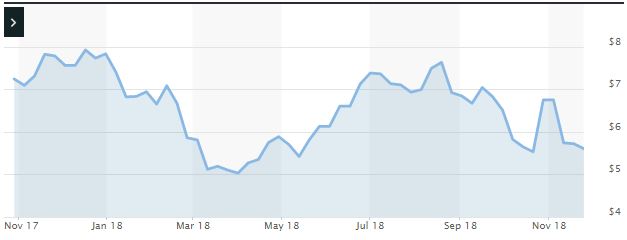

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is January 8, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Sonus common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.