TDOC Class Action; Levi & Korsinsky Announces TDOC Lawsuit

Levi & Korsinsky, LLP

January 8, 2019

Reiner v. Teladoc Health, Inc., et al 1:18-cv-11603-GHW — On December 12, 2018, investors sued Teladoc Health, Inc., (“Teladoc” or the “Company”) in United States District Court, Southern District of New York. The TDOC class action alleges that plaintiffs acquired Teladoc stock at artificially inflated prices between March 3, 2016 and December 5, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the TDOC lawsuit, please contact us today!

Summary of the Allegations

Company Background

Founded in 2002, Teladoc (NYSE: TDOC) is based in Purchase, New York and provides global telehealth services.

Specifically, the Company provides comprehensive services and solutions addressing more than 400 medical subspecialties ranging from the flu to cancer and congestive heart failure. These services are provided through mobile devices, the Internet, video and phone.

According to its website, the Company has offices throughout the world and serves “millions of people” in 125 countries. To do so, Teladoc says it provides access to care in more than 20 languages.

Prior to adopting its current moniker in August 2018, the Company was known as Teladoc, Inc.

Summary of Facts

Teladoc and two of its senior officers (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about the Company’s business practices, operational and compliance policies during the Class Period.

Specifically, they are accused of omitting truthful information about a top executive’s conduct, and the enforcement of certain Company policies from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Teladoc stock to trade at artificially inflated prices during the time in question.

The truth came out in an article published by the Southern Investigative Research Foundation (“SIRF”) on December 5, 2018. In it, SIRF reported that Teladoc’s CFO, who is also named as an Individual Defendant in the December 12 complaint, had been involved in “an affair… with an employee many levels below him on the company’s organizational chart.”

The article also asserted that, “during their relationship [the employee] received a series of promotions over colleagues with either more industry experience or better credentials that stunned her former colleagues.” Finally, the article included allegations that the participants in the affair “liked to trade Teladoc Health’s stock together,” with the Individual Defendant advising his lover “when he thought there were good opportunities to sell some shares.”

A closer look…

As alleged in the December 12 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements throughout the Class Period.

For instance, on a form filed with the SEC at the beginning of the Class Period, the Company stated in pertinent part: “We depend on our senior management team, and the loss of one or more of our executive officers or key employees, or an inability to attract and retain highly skilled employees could adversely affect our business.”

On another form filed with the SEC on April 15, 2016, the Company also said in pertinent part: “Teladoc is committed to the highest standards of integrity and ethics in the way it conducts business.”

Finally, on a form filed with the SEC on April 6, 2017, the Company stated in pertinent part: “[t]he Board has also adopted a Code of Business Conduct and Ethics that applies to all directors, officers and employees. The purpose of this code is to promote honest and ethical conduct for conducting the business of the Company consistent with the highest standards of business ethics.”

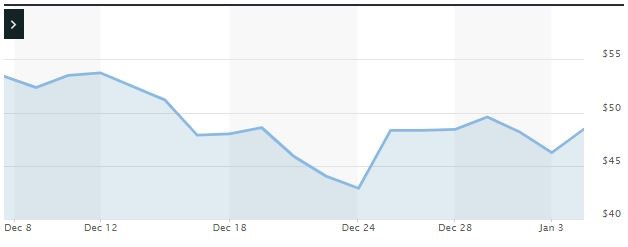

Impact of the Alleged Fraud on Teladoc’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$59.81 |

| Closing stock price the trading day after disclosures:

|

$55.81 |

| One day stock price decrease (percentage) as a result of disclosures:

|

6.69% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is February 11, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Teladoc common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.