TRVN Lawsuit; Levi & Korsinsky Announces TRVN Class Action

Levi & Korsinsky, LLP

October 24, 2018

Tomaszewski v. Trevena, Inc. et al 2:18-cv-4378 — On October 10, 2018, investors sued Trevena, Inc. (“Trevena” or the “Company”) in United States District Court, Eastern District of Pennsylvania. The TRVN class action alleges that plaintiffs acquired Trevena stock at artificially inflated prices between May 2, 2016 and October 8, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the TRVN Lawsuit, please contact us today!

Summary of the Allegations

Company Background

Founded in 2007, Trevena (NASDAQ: TRVN) is a self-described “clinical stage biopharmaceutical company.”

As such, it claims that it engages in the discovery, development of certain therapeutics with the intent to commercialize them. Specifically, the Company claims that these therapeutics “use a novel approach to target G protein coupled receptors, or GCPRs.”

Finally, Trevena says its history is “rooted in strong science,” and that it was created to “translate Nobel Prize-winning research into a new generation of groundbreaking medicines.”

The Company’s statements about certain interactions with the FDA are at the crux of the October 10 complaint.

Summary of Facts

Trevena and two of its former officers (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about one of its product candidates during the Class Period.

Specifically, they are accused of omitting truthful information about the FDA’s assessment of one of its product candidates from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Trevena stock to trade at artificially inflated prices during the time in question.

The truth came out when the FDA released a Briefing Document related to Trevena on October 9, 2018. Contrary to the Company’s public representations, information in the document reflected the FDA’s concerns about Trevena’s product candidate, olicerdine. In fact, the document, which included minutes from an April 28, 2016 meeting revealed that the FDA: “did not agree with the proposed dosing in the Phase 3 studies”; “did not agree with the proposed primary endpoint”; and “did not agree with the proposed non-inferiority (NI) margin for comparing morphine to olicerdine.”

A closer look…

As alleged in the October 10 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For instance, in a press release issued at the beginning of the Class Period, the Company said in relevant part: “The Company has reached general agreement with the FDA on key elements of the Phase 3 program to support a New Drug Application (NDA) for olicerdine (TRV130), to which the FDA has granted Breakthrough Therapy designation.”

In the same press release, Trevena also said in pertinent part: “In addition, general agreement was reached on the company’s planned clinical, nonclinical, clinical pharmacology, and chemistry, manufacturing and control (CMC) activities to support the planned NDA.”

Trevena reiterated its statement about its announcement and alleged agreement with the FDA on forms filed with the SEC on May 5, 2016, and August 4, 2016. In each instance, the Company also filed certifications signed by the Individual Defendants in which they certified that based on their knowledge the report did not contain: “any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report.”

Both Individual Defendants also certified that they disclosed that they disclosed, “any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.”

Impact of the Alleged Fraud on Trevena’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$2.98 |

| Closing stock price the trading day after disclosures:

|

$1.91 |

| One day stock price decrease (percentage) as a result of disclosures:

|

64.09% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is December 10, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Trevena common stock using court approved loss calculation methods.

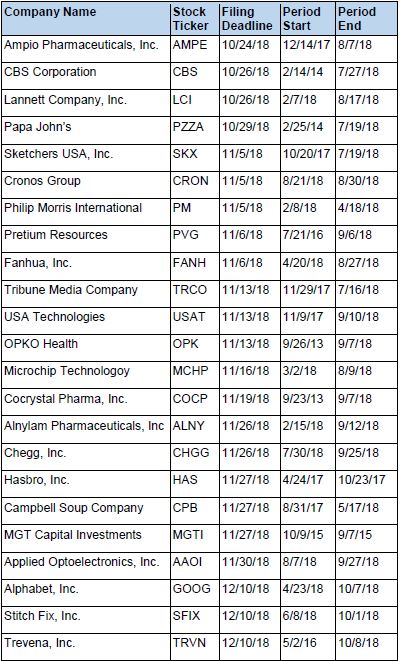

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.