Levi & Korsinsky Announces TYME Lawsuit; TYME Class Action

Levi & Korsinsky, LLP

February 12, 2019

Canas v. Tyme Technologies, Inc., et al 1:19-cv-00843-RA — On January 28, 2019, investors sued Tyme Technologies, Inc. (“Tyme” or the “Company”) in United States District Court, Southern District of New York. Plaintiffs in the TYME class action allege that they acquired Tyme stock at artificially inflated prices between March 14, 2018 and January 18, 2019 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the TYME lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, Tyme (NASDAQ: TYME) is a clinical-stage biotechnology company engaged in the development of cancer treatments “that are intended to be broadly effective across a range of tumor types, while maintaining patient’s quality of life with relatively low toxicity profiles.”

The Company, which has been in business since 2011 says its “therapeutic approach” differs from that employed by other biotech companies. Specifically, Tyme says its approach “is designed to take advantage of a cancer cell’s innate metabolic requirements to compromise its defenses, leading to cell death and exposure to the body’s immune system.”

The Company also says its lead product candidate, SM-88, is an oral amino acid-based therapy with a profile that is backed by more than five years of clinical data in more than 100 cancer patients in which the disease has spread. Tyme’s claims about SM-88 are at the crux of the January 28 complaint.

Summary of Facts

Tyme and two of its senior officers and/or directors (the “Individual Defendants”) are now accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices and compliance policies during the Class Period.

Specifically, they are accused of omitting truthful information about the status of a Phase II clinical trial for SM-88 from SEC filings and related information. By knowingly or recklessly doing so, they allegedly caused Tyme stock to trade at artificially inflated prices during the time in question.

The truth came out in a series of events that transpired on January 18, 2019. First, the Company reported results from the Phase II study, which it characterized as “positive.” In doing so, however, the Company revealed that the trial did not include a control group and that its announcement “merely compared survival data to historical controls.”

In an article assessing the situation published that day, The Motley Fool noted: “The problem with historical controls is that it’s really hard to know if the 14 patients have the same characteristics as the patients who were in the previous clinical trials. And even if the patients were fairly similar, the history of best standard of care has generally improved over time, so historical controls has typically gotten better for most types of cancer.”

A closer look…

As alleged in the January 28 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a press release issued on April 9, 2018, one of the Individual Defendants “touted the Company’s recent success” and stated in relevant part: “We are now fully focused on successfully achieving multiple data milestones over the next 12 months.”

Then, in another press release issued on June 12, 2018, the same Individual Defendant also said in pertinent part: “We are highly encouraged by the data with SM-88 from these studies in terms of the apparent safety and efficacy shown by the drug, as well as the breadth of cancer indications for which responses were observed…”

Finally, an annual report filed with the SEC on June 13, 2018, contained only generic, standard language pertaining to the Company’s “lack of experience completing Phase II clinical trials or commercializing pharmaceutical products. It simply stated: “We have no history of completing large-scale, pivotal Phase II or III clinical trials or commercializing pharmaceutical products, which may make it difficult to evaluate the prospects for our future viability.”

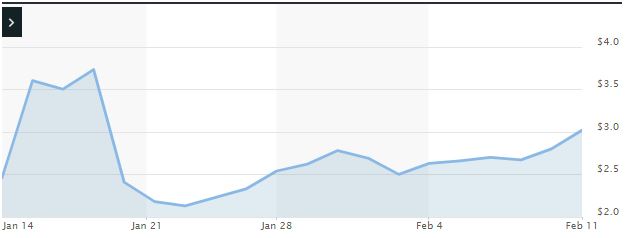

Impact of the Alleged Fraud on Tyme’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$3.73 |

| Closing stock price the trading day after disclosures:

|

$2.41 |

| One day stock price decrease (percentage) as a result of disclosures:

|

35.39% |

The following chart illustrates the stock price during the Class Period

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is March 29, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Tyme common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.